Deciphering the Tweezer Tops: Unveiling the Bearish Reversal Pattern

In the realm of technical analysis, candlestick patterns act as a visual language, conveying intricate messages about market sentiment and potential price movements. Among these patterns, the Tweezer Tops pattern stands out as a significant indicator of a bearish reversal.

The Art of Reading Candlestick Patterns

Candlestick patterns serve as a bridge between market data and trader intuition. By visualizing price movements over specific time frames, these patterns offer insights into market sentiment, allowing traders to make informed decisions.

The Tweezer Tops: A Prelude

Among the myriad candlestick patterns, the Tweezer Tops pattern emerges as a potent indicator of a potential trend reversal. This pattern showcases the delicate balance between bullish and bearish forces in the market.

2. Understanding Candlestick Patterns

Visualizing Market Sentiment through Candles

Candlestick charts display price data through a combination of individual candles, each representing the opening, closing, high, and low prices within a specific period. The shape and arrangement of candles reveal the emotional undercurrents driving price movements.

Patterns as Roadmaps for Traders

Candlestick patterns provide traders with a roadmap of potential price movements. These patterns can be categorized into reversal and continuation patterns. The Tweezer Tops pattern, falling under the former category, warns of a possible change in the prevailing trend.

3. Exploring the Tweezer Top Candlestick Pattern

Identifying the Tweezer Tops

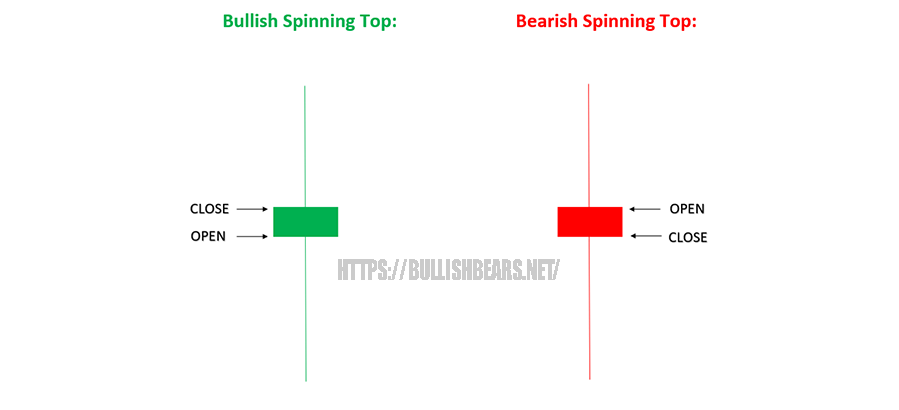

The Tweezer Tops pattern is characterized by two consecutive candlesticks with nearly identical highs, forming a horizontal line, or “top.” These candlesticks can have varying bodies—bullish, bearish, or doji—but share the same high price level.

The Anatomy of the Tweezer Top Pattern

The Tweezer Tops pattern consists of:

- A bullish candlestick representing an uptrend.

- A subsequent bearish candlestick with the same high as the previous bullish candle, signaling a potential reversal.

Interpreting the Pattern’s Significance

The Tweezer Tops pattern signifies a shift in sentiment from bullish optimism to potential bearish pressure. The inability of the bulls to sustain higher prices becomes evident as the second candlestick closes lower, suggesting a loss of momentum.

4. Decoding the Meaning of Tweezer Tops

Connotations of the Tweezer Tops Pattern

The Tweezer Tops pattern encapsulates indecision and potential trend reversal.

The Tug-of-War between Bulls and Bears

The Tweezer Tops pattern illustrates a power struggle between buyers and sellers. While the initial bullish candle indicates strong buying interest, the subsequent bearish candle suggests increasing selling pressure, creating a pivotal moment for traders.

5. Tweezer Tops in Stocks and Forex Trading

Tweezer Tops in Stock Market Analysis

In the realm of stocks, the Tweezer Tops pattern serves as a warning sign for traders and investors. When identified in stock charts, this pattern can prompt traders to reevaluate their positions and consider potential bearish reversals.

Tweezer Tops as Forex Reversal Signals

Tweezer Tops also hold significance in the forex market. As forex trading involves currency pairs, patterns like the Tweezer Tops can indicate potential shifts in exchange rates, leading traders to adjust their strategies accordingly.

Considerations for Different Markets

While the essence of the Tweezer Tops pattern remains consistent across markets, traders must consider the unique dynamics of each market. Volatility, liquidity, and other factors can impact the pattern’s effectiveness in different financial instruments.

6. Incorporating the Tweezer Top Pattern into Trading Strategies

Recognizing Tops Tweezer for Entry Points

For traders seeking to capitalize on bearish reversals, the Tops Tweezer pattern provides valuable entry points. However, it’s essential to exercise caution and combine the pattern’s signals with other technical indicators to confirm the likelihood of a reversal.

Confirmation with Other Indicators

Successful trading strategies often involve confirmation from additional indicators, such as moving averages, relative strength index (RSI), and trendlines. These indicators can provide additional insights into the strength of the reversal signal.

Risk Management and Stop-Loss Placement

Risk management remains a crucial aspect of trading. Traders should define appropriate stop-loss levels to protect against potential losses in case the reversal signal is not confirmed.

7. Backtesting and Historical Performance Analysis

Analyzing the Reliability of Tops Tweezer

To assess the reliability of the Tweezer Tops pattern, traders often engage in backtesting. By analyzing historical price data, traders can determine how frequently the pattern has accurately predicted trend reversals.

Learning from Past Trades

Backtesting not only offers insights into the pattern’s accuracy but also provides valuable lessons from past trades. Traders can refine their strategies based on historical performance.

Combining Historical Data with Real-Time Insights

While historical data is informative, traders must complement it with real-time analysis. Market conditions, news events, and other factors can influence the pattern’s effectiveness in the present.

8. The Psychological Dynamics Behind Tops Tweezer

Understanding Traders’ Behavior in the Pattern

The Tops Tweezer pattern underscores the psychological dynamics of trading. It represents a shift in sentiment from exuberance to caution or even pessimism, mirroring the emotions of traders as they reassess their positions.

Fear, Greed, and Reversal Signals

The fear of missing out (FOMO) that drives bullish trends can swiftly turn into fear of losses when the market shows signs of reversing. Greed, which propels bullish movements, can morph into anxiety when bearish signals emerge.

Emotional Elements in Technical Analysis

Technical analysis is not devoid of emotions. Traders’ reactions to patterns like Tweezer highlight the intricate interplay between human psychology and market movements.

9. Evolving Trends in Technical Analysis

These tools can scan vast amounts of data to identify patterns like Tweezer with greater accuracy.

Tweezer Tops in Algorithmic Trading

Algorithmic trading strategies can incorporate Tweezer Tops patterns as part of automated decision-making processes. Algorithms can recognize patterns, execute trades, and manage risk with speed and precision.

Balancing Automation with Human Expertise

While automation enhances efficiency, human expertise remains irreplaceable. Traders must strike a balance between automated analysis and their own insights to make informed decisions.

10. Conclusion

Leveraging Tweezer Tops for Informed Decisions

The Tweezer Tops pattern serves as a powerful tool for traders seeking to anticipate bearish reversals. Recognizing this pattern’s significance and understanding its implications can empower traders to navigate the markets with confidence.