Spinning Top

In the ever-evolving world of cryptocurrency trading, it’s essential for traders and investors to understand various chart patterns that can provide insights into price movements. One such pattern is the spinning top, a crucial candlestick pattern that can be particularly useful when navigating the volatile waters of lightning crypto assets. In this article, we will explore what a spinning top is, its significance in candlestick chart analysis, and how it relates to lightning network crypto, lightning cryptocurrency exchanges, and the lightning crypto wallet.

Understanding the Spinning Top Candlestick Pattern

Before we delve into the implications of the candlestick pattern in the context of lightning crypto, let’s first understand what it represents in technical analysis. A is a candlestick pattern that reflects a market indecision between buyers and sellers. It is characterized by a small real body (the difference between the opening and closing prices) and long upper and lower shadows (wicks) that indicate significant price volatility during the trading period.

The Spinning Top Candlestick Pattern

Before diving into the world of Lightning crypto, let’s briefly understand the spinning top candlestick pattern. A spinning top is a single candlestick pattern that indicates indecision in the market. It has a small real body, indicating a narrow range between the opening and closing prices, and has upper and lower shadows that reflect price volatility during the trading session. In essence, it suggests that neither the bulls nor the bears are in complete control, and the market is in a state of equilibrium or uncertainty.

The Significance of a Spinning Top

- Indecision: A spinning top indicates that neither bulls nor bears have taken control during the trading session. It suggests that there is uncertainty in the market, and traders should exercise caution.

- Trend Reversal Potential: In some cases, a spinning top can signal a potential reversal in the current trend. If it occurs after a prolonged uptrend or downtrend, it might indicate that the trend is losing momentum, and a reversal could be on the horizon.

- Volatility Alert: The long upper and lower shadows on a highlight increased price volatility. This can be particularly relevant in the world of lightning network crypto, where rapid price movements are common.

Spinning Top in Lightning Network Crypto

The lightning network is a second-layer solution built on top of various blockchain platforms, primarily designed to address scalability and speed issues. Lightning crypto assets are those that utilize the lightning network for faster and cheaper transactions. When analyzing the price charts of these assets, the spinning top candlestick pattern can provide valuable insights.

- Market Uncertainty: Just like in traditional cryptocurrency trading, a spinning top in the candlestick chart of a lightning crypto asset suggests uncertainty in the market. Traders using the lightning network crypto may want to be cautious when making decisions during such periods of indecision.

- Lightning Cryptocurrency Exchange: Traders on lightning cryptocurrency exchanges should pay close attention to spinning tops, as they might indicate potential reversals or increased volatility. Utilizing stop-loss orders and taking profit at strategic points can help mitigate risks associated with such patterns.

- Lightning Crypto Wallets: For users of lightning crypto wallets, understanding candlestick patterns like the spinning top can be valuable for timing transactions. If a spinning top occurs on the chart of the crypto asset you intend to transact with, it may be wise to wait for a clearer market direction before proceeding with your lightning network transactions.

Conclusion

In the world of cryptocurrency trading, understanding candlestick patterns like the is essential for making informed decisions, especially when dealing with lightning network crypto assets. While a signifies market indecision, its implications can be far-reaching for traders, investors, and users of lightning cryptocurrency exchanges and wallets. By staying vigilant and using technical analysis tools effectively, individuals can navigate the volatile waters of the crypto market with greater confidence and success.

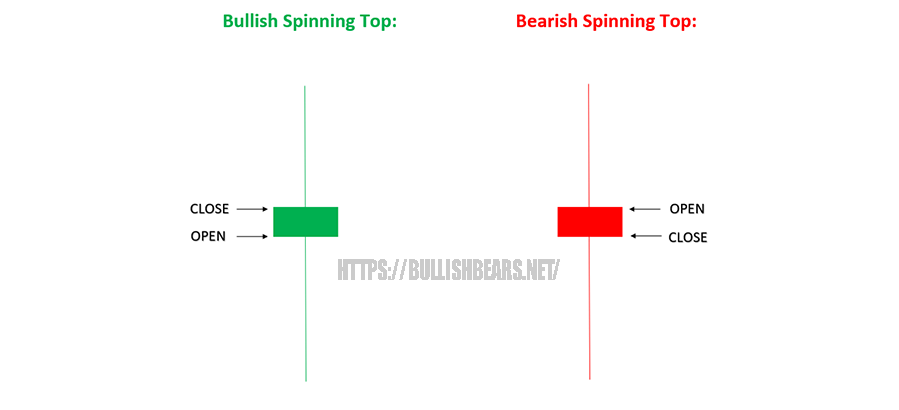

A “Bullish Spinning Top” is a candlestick pattern often observed in technical analysis of financial markets, particularly in stock trading and forex trading. This pattern is significant because it can provide valuable insights into potential price reversals and shifts in market sentiment.

Here’s a breakdown of what a Bullish Spinning Top represents:

- Appearance: A Bullish Spinning Top is characterized by a small candle body, where the opening and closing prices are very close to each other. This forms the “spinning top” shape. The key feature is that it has long upper and lower wicks (shadows) extending above and below the small body.

- Market Sentiment: This pattern indicates a tug of war between buyers and sellers. The small body suggests that neither the bulls (buyers) nor the bears (sellers) have a strong grip on the market at the moment. However, the long wicks show that there was significant price volatility during the trading period.

- Bullish Signal: A Bullish Spinning Top is considered a potential bullish reversal signal when it appears after a downtrend. It suggests that despite the recent selling pressure, buyers are starting to regain control, and the market sentiment may be shifting towards a bullish bias.

- Confirmation: Traders typically look for confirmation of the bullish reversal by observing the price action in the subsequent candlesticks. If the next candlestick closes higher and confirms the upward momentum, it strengthens the bullish signal.

- Caution: While a Bullish Spinning Top can be a promising sign for bulls, it’s essential to exercise caution. This pattern alone is not a guarantee of a trend reversal, and traders should consider other technical indicators and fundamental factors to make informed trading decisions.

- Stop Loss: Risk management is crucial in trading. Traders often place a stop-loss order below the low of the Bullish Spinning Top to limit potential losses if the reversal does not materialize.

In summary, a Bullish Spinning Top is a candlestick pattern that suggests a potential shift in market sentiment from bearish to bullish. It’s a signal for traders to monitor the market closely and look for confirmation of the trend reversal. However, like any technical pattern, it should be used in conjunction with other analysis tools for more accurate trading decisions.