Tweezer Bottoms

A Comprehensive Guide to the Bullish Reversal Pattern

In the world of cryptocurrency trading, where markets are known for their extreme volatility, traders are constantly seeking reliable tools to make informed decisions. One such tool is the “Tweezer Bottoms” pattern, a powerful bullish reversal pattern that can help traders identify potential buying opportunities and generate free crypto signals. Table of Contents

Understanding Candlestick Patterns

Candlestick patterns have been a staple of technical analysis for centuries. They provide traders with visual representations of price movements during a specific timeframe, offering insights into market sentiment and potential reversals. Tweezer Bottoms are a subset of these patterns, and they are particularly useful for identifying bullish reversal opportunities in the crypto market.

The Importance of Reversal Patterns

Successful trading is not just about knowing when to buy low and sell high; it also involves recognizing when a trend is about to change. Reversal patterns like Tweezer Bottoms play a critical role in helping traders spot these turning points, allowing them to enter positions at opportune moments.

2. The Anatomy of Tweezer Bottoms

What Are Tweezer Bottoms?

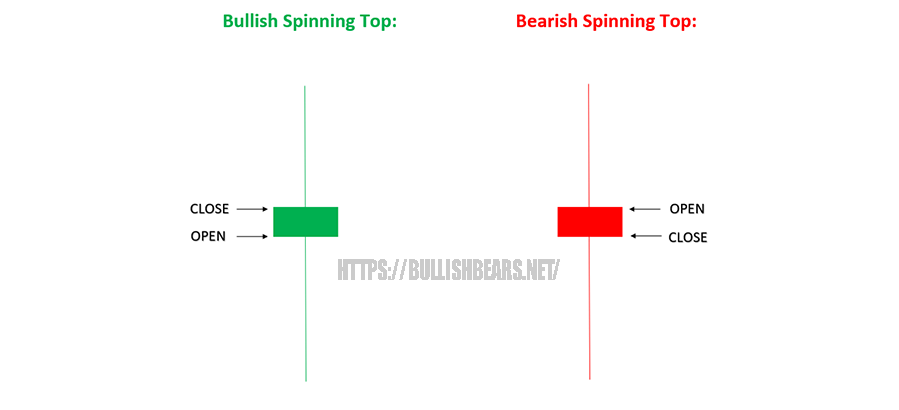

Tweezer Bottoms are a two-candlestick pattern that occurs at the end of a downtrend. This pattern consists of two distinct candlesticks:

- The first candlestick is bearish (red) and signifies a period of selling pressure.

- The second candlestick is bullish (green) and opens at or near the same level as the previous candlestick’s low.

The two candlesticks together resemble a pair of tweezers, which is how the pattern gets its name. Tweezer Bottoms are characterized by their equal or nearly equal lows, indicating that the bears have lost momentum, and the bulls may be ready to take control.

Identifying the Pattern

Recognizing Tweezer Bottoms requires attention to detail and practice. Here are the key steps to identify this pattern:

- Downtrend: First, confirm that the market is in a downtrend. You should see a series of lower highs and lower lows on the price chart.

- Bearish Candlestick: Look for a bearish candlestick that shows selling pressure. This candlestick should have a noticeable lower wick, indicating that prices dropped during the trading session.

- Bullish Candlestick: Following the bearish candle, there should be a bullish candlestick with an opening price that is near or at the same level as the low of the previous bearish candle. The bullish candle should ideally have a strong upward body.

- Equal or Near-Equal Lows: The most crucial aspect of Tweezer Bottoms is that the low of the bullish candle should be very close to or exactly equal to the low of the preceding bearish candle. This proximity of lows signifies potential exhaustion of the bearish trend.

Interpretation and Significance

Tweezer Bottoms are a strong bullish reversal signal, and their appearance suggests that the bears are losing control, and the bulls may be preparing to drive prices higher. Traders interpret Tweezer Bottoms as a sign to consider buying or going long on the cryptocurrency in question. However, it’s essential to keep in mind that no pattern is foolproof, and risk management should always be a part of your trading strategy.

3. Tweezer Bottoms in Crypto Trading

Crypto Market Volatility

The cryptocurrency market is notorious for its high volatility. Prices can experience rapid and substantial fluctuations within a short period. While this volatility presents opportunities for traders, it also poses significant risks. Tweezer Bottoms can be particularly valuable in the crypto market because they help traders navigate these price swings and make sense of market sentiment.

How Tweezer Bottoms Apply to Cryptocurrency

Tweezer Bottoms are applicable to cryptocurrency trading in the same way they are to other financial markets. However, their significance may be amplified in the crypto space due to the market’s sensitivity to sentiment changes. When Tweezer Bottoms appear in cryptocurrency charts, they often attract the attention of traders and can lead to substantial price reversals.

Advantages of Using Tweezer Bottoms

There are several advantages to incorporating Tweezer Bottoms into your crypto trading strategy:

- Clear Entry Signals: Tweezer Bottoms provide relatively clear entry signals, making them suitable for both novice and experienced traders.

- Versatility: This pattern can be used for various cryptocurrencies and timeframes, from short-term day trading to long-term investing.

- Risk Management: Tweezer Bottoms can help traders set appropriate stop-loss levels, limiting potential losses if the reversal doesn’t materialize as expected.

- Objective Analysis: Unlike some other forms of analysis, Tweezer Bottoms offer a more objective way to assess potential buying opportunities, as they rely on specific price patterns.

4. Generating Crypto Signals with Tweezer Bottoms

Entry Points and Stop-Loss

One of the primary uses of Tweezer Bottoms is to identify entry points for trades. When a Tweezer Bottoms pattern forms at the end of a downtrend, it suggests that the bears are losing control, and a bullish reversal may be imminent. Traders often interpret this as a signal to consider buying the cryptocurrency.

To generate a crypto signal using Tweezer Bottoms, follow these steps:

- Confirmation: Wait for confirmation of the bullish reversal. This can include monitoring the price action after the pattern forms to ensure that it’s indeed transitioning into an uptrend.

- Entry Point: Once you’re reasonably confident in the reversal, determine your entry point. Some traders enter immediately after the bullish candlestick closes, while others may wait for additional confirmation or retracement.

- Stop-Loss: Set a stop-loss order to limit potential losses. A common approach is to place the stop-loss just below the low of the Tweezer Bottoms pattern.

- Take Profit: Establish a take-profit level to secure profits once the price moves in your favor. This level can be based on technical analysis, support and resistance levels, or other indicators.

Using Tweezer Bottoms for Short-Term and Long-Term Trading

Tweezer Bottoms can be applied to both short-term and long-term trading strategies in the crypto market.

- Short-Term Trading: Day traders and short-term traders can use Tweezer Bottoms to identify quick buying opportunities during intraday price movements. Since the pattern signifies a potential reversal, it’s well-suited for traders looking to capitalize on short-term price swings.

- Long-Term Investing: Long-term investors can also benefit from Tweezer Bottoms by using them as entry signals for longer-term positions. When this pattern appears on higher timeframes like daily or weekly charts, it can signal the start of a more extended bullish trend, making it valuable for investors seeking to hold assets for an extended period.

5. Enhancing Your Crypto Trading Strategy

Combining Tweezer Bottoms with Other Indicators

While Tweezer Bottoms are a potent tool on their own, traders often enhance their strategies by combining them with other technical indicators. Some commonly used indicators include:

- Moving Averages: Moving averages help smooth out price data, making it easier to identify trends. Traders may look for a Tweezer Bottoms pattern that aligns with a moving average crossover to increase their confidence in a trade.

- Relative Strength Index (RSI): RSI measures the momentum of price movements. When Tweezer Bottoms form in conjunction with RSI divergences (e.g., bullish divergence), it can provide additional confirmation of a potential trend reversal.

- Fibonacci Retracement Levels: Traders use Fibonacci retracement levels to identify potential support and resistance levels. Combining Tweezer Bottoms with these levels can help pinpoint entry and exit points.

Risk Management Strategies

Successful crypto trading isn’t just about finding profitable trades; it’s also about managing risk effectively. Here are some risk management strategies to consider when trading with Tweezer Bottoms:

- Position Sizing: Determine the size of your position based on your risk tolerance and the size of your trading account. Avoid risking too much of your capital on a single trade.

- Stop-Loss Orders: Always use stop-loss orders to limit potential losses. Placing the stop-loss just below the low of the Tweezer Bottoms pattern is a common approach.

- Take-Profit Levels: Set take-profit levels to secure profits once the trade moves in your favor. Consider using a trailing stop to capture additional gains as the price continues to rise.

- Diversification: Avoid putting all your capital into a single trade or cryptocurrency. Diversifying your portfolio can help spread risk.

- Risk-Reward Ratio: Assess the risk-reward ratio of each trade. Ensure that the potential reward justifies the risk you are taking.

Learning from Real-Life Examples

To master the art of trading with Tweezer Bottoms, it’s essential to study real-life examples. Analyze historical price charts of cryptocurrencies and identify instances where Tweezer Bottoms patterns signaled successful reversals. This hands-on experience will help you refine your ability to recognize and interpret these patterns accurately.

6. Tweezer Bottoms on Telegram and Other Platforms

Leveraging Social Trading

Social trading platforms and communities have gained popularity in recent years, providing traders with opportunities to share insights, discuss trading strategies, and even receive free crypto signals. Telegram, in particular, has become a hub for crypto enthusiasts and traders. It’s not uncommon to find crypto signals Telegram groups where traders discuss and share their insights, including those related to Tweezer Bottoms.

The Role of Crypto Signals Telegram Groups

Crypto signals Telegram groups can be a valuable resource for traders looking to stay updated on potential trading opportunities. In these groups, experienced traders or signal providers share their analyses and trading signals, including those based on Tweezer Bottoms patterns. While these signals can be informative, it’s essential to exercise caution and conduct your analysis before acting on them.

7. Daily Cryptocurrency Trading Signals and Tweezer Bottoms

Incorporating Tweezer Bottoms into Daily Trading Routines

For many traders, particularly those engaged in day trading, incorporating Tweezer Bottoms into their daily routine is a common practice. This involves regularly scanning cryptocurrency charts for potential Tweezer Bottoms patterns and using them to inform trading decisions. Since cryptocurrency markets operate 24/7, traders need to adapt to this constant market activity.

The Role of Consistency in Trading

Consistency is a key factor in successful trading. Establishing a daily routine that includes chart analysis, monitoring for Tweezer Bottoms patterns, and adhering to risk management principles can help traders maintain discipline and improve their chances of long-term success.

8. The Best Crypto Signals Providers

Evaluating Signal Providers

As traders explore the world of crypto signals, they may encounter various signal providers and services. When choosing a signal provider, it’s essential to evaluate their credibility and track record. Consider the following factors:

- Accuracy: Look for signal providers with a history of accurate signals.

- Transparency: Providers should be transparent about their methodologies and past performance.

- Reputation: Check for reviews and feedback from other users.

- Customer Support: Assess the quality of customer support and responsiveness.

- Risk Disclosure: Ensure that the provider discloses the risks associated with trading.

Red Flags to Watch Out For

While there are reputable crypto signals providers, there are also fraudulent or unreliable ones. Be cautious of providers who:

- Promise Guaranteed Profits: No one can guarantee profits in trading.

- Lack Transparency: If a provider is secretive about their strategies or results, be wary.

- Charge Exorbitant Fees: High fees can eat into your profits.

- Use Pressure Tactics: Providers who pressure you to sign up or deposit funds should be avoided.

Realizing the Limitations of Crypto Signals

While crypto signals, including those based on Tweezer Bottoms, can be valuable, it’s crucial to understand their limitations. No signal is foolproof, and the cryptocurrency market’s inherent volatility means that unexpected events can occur. Therefore, always conduct your research and use signals as one part of your trading strategy rather than relying solely on them.

9. Crypto Signals vs. DIY Trading

The Pros and Cons of Both Approaches

Trading with crypto signals offers certain advantages, such as saving time and gaining insights from experienced traders. However, it also has drawbacks, including the potential for reliance on others’ analyses and signals.

10. Conclusion: Bottoms Tweezer as a Valuable Tool in Crypto Trading

In conclusion, Tweezer Bottoms are a valuable candlestick pattern that holds significant potential for traders in the cryptocurrency market. Understanding this pattern, its significance, and how to incorporate it into your trading strategy can improve your ability to identify bullish reversals and generate profitable crypto signals. However, it’s crucial to remember that trading carries inherent risks, and no pattern or signal can guarantee success.

As you embark on your crypto trading journey, consider Tweezer Bottoms as one of the tools in your trading toolkit. Combine it with thorough analysis, risk management, and a commitment to continuous learning. By doing so, you can navigate the dynamic and exciting world of cryptocurrency trading with greater confidence and skill.