Hanging Man Candlestick Pattern

One such tool is the Hanging Man candlestick pattern. In this article, we will delve into the Hanging Man pattern, its significance in crypto trading, and how it can complement crypto signals to empower traders with valuable insights for their trading strategies.

Understanding the Hanging Man Candlestick Pattern

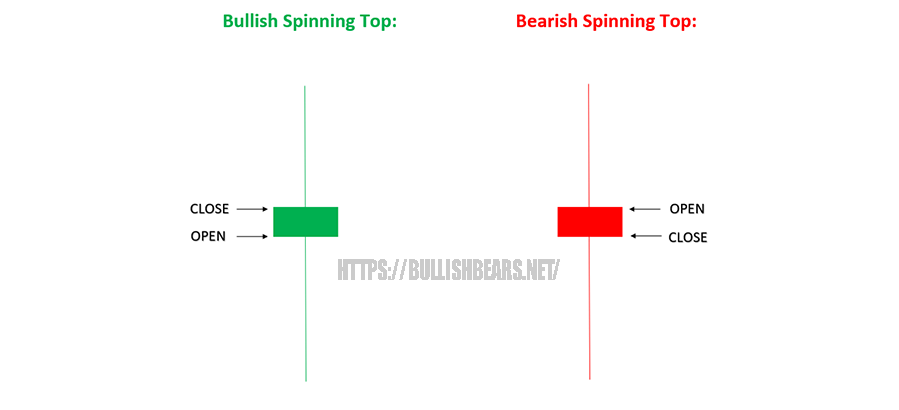

The Hanging Man is a single-candlestick pattern that often appears at the end of an uptrend. It is characterized by a small real body near the high of the session and a long lower shadow. Key elements of the executioner light pattern include:

- Small Real Body: The open and close prices are usually near the high of the session, creating a small real body that resembles the head of a hammer.

- Long Lower Shadow: The long lower shadow extends below the real body and represents the low price reached during the session.

- Little to No Upper Shadow: The upper shadow is typically small or nonexistent, indicating minimal selling pressure during the session’s high.

Significance in Crypto Trading

The Hanging Man is considered a bearish reversal signal and is closely watched by crypto traders for several reasons:

- Bearish Reversal Signal: The Hanging Man emerges after a sustained uptrend, suggesting that buyers attempted to push prices higher but failed. This failure can signal a shift in market sentiment from bullish to bearish.

- Resistance Level: The high point of the Hanging Man’s real body can act as a resistance level, indicating that the cryptocurrency may struggle to break above that level in the near term.

- Profit-taking: Traders who were previously long on the cryptocurrency may use the Hanging Man pattern as an opportunity to take profits, further contributing to the bearish sentiment.

Using Crypto Signals with Hanging Man Patterns

Integrating the Hanging Man pattern with crypto signals can enhance your trading strategy. Crypto signals provide insights into potential entry and exit points, and when combined with the Executioner light pattern, they can offer more robust guidance for your trading decisions:

- Confirmation of Bearish Signals: When you receive a crypto signal suggesting a potential short or sell opportunity, look for a Hanging Man pattern on the corresponding cryptocurrency’s chart. If you spot a Hanging Man after an uptrend, it can serve as a confirming signal for the bearish sentiment.

- Risk Management: Pair the Executioner light’s bearish signal with effective risk management strategies such as setting stop-loss orders. This helps protect your capital in case the trade doesn’t go as planned.

- Time Frame Considerations: Be mindful of the time frame you are trading on, as Hanging Man patterns can appear on various time frames. Adjust your trading strategy and risk management based on your chosen time frame.

The Hanging Man Candlestick pattern is a single-candle pattern characterized by a small real body, a long lower shadow, and little to no upper shadow. It typically occurs after an uptrend and may signal a potential reversal. Here are the key features of a Executioner light:

- Small Real Body: The opening and closing prices are close together, creating a small body, often resembling a plus sign or a “T.”

- Long Lower Shadow: The lower shadow extends well below the real body and represents the lowest price reached during the trading session.

- Little to No Upper Shadow: There is little to no upper shadow, indicating minimal selling pressure during the session.

Conclusion

In the ever-changing landscape of cryptocurrency trading, traders seek reliable tools to make informed decisions and navigate market fluctuations. The Hanging Man candlestick pattern, with its potential to signal bearish reversals, can be a valuable addition to a trader’s toolbox.

When used in conjunction with crypto signals, traders can gain added confidence in their trading strategies, leading to improved risk management and potentially more profitable trades. However, it’s crucial to remember that no single indicator or pattern guarantees success, and thorough analysis and risk management are essential for successful trading in the dynamic crypto market.