Gravestone Doji Candlestick Patterns

Introduction

One such tool that has gained popularity among traders is the Gravestone Doji candlestick pattern. This pattern can be a crucial element of your crypto trading strategy, especially when combined with crypto signals. In this article, we will explore the Gravestone Doji pattern, its significance in crypto trading, and how it can complement your crypto trading signals.

Understanding the Gravestone Doji Candlestick Pattern

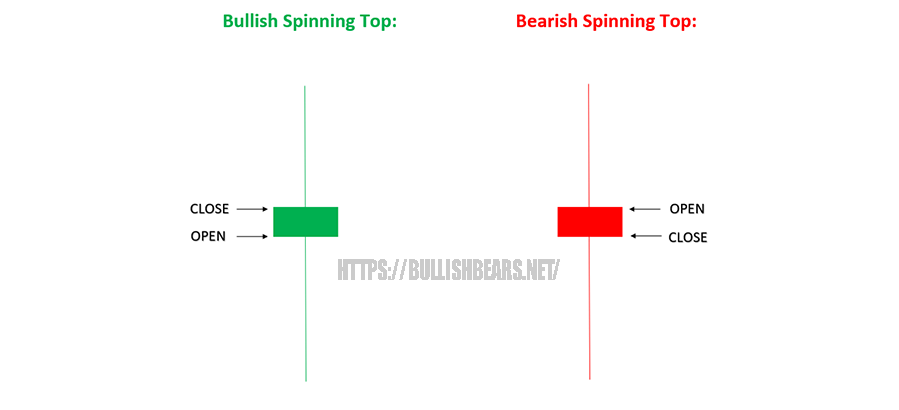

The Gravestone Doji is a single-candlestick pattern that can appear in both bullish and bearish trends. It is characterized by its unique shape, which resembles a gravestone or an inverted letter “T.” Here are the key elements of a Gravestone Doji:

- Long Upper Shadow: The Gravestone Doji has a long upper shadow, indicating that during the trading session, prices moved significantly higher.

- Small or No Lower Shadow: The lower shadow is either very small or non-existent, suggesting minimal price movement to the downside.

- Open and Close: The open and close prices are usually near the low of the session, with the close slightly below or at the open.

Significance in Crypto Trading

The Gravestone Doji is considered a bearish reversal pattern. In the highly volatile world of cryptocurrencies, where prices can change rapidly, identifying potential trend reversals is crucial for traders. The Doji pattern, when used in conjunction with other technical analysis tools and strategies, can serve as a valuable confirmation signal for traders.

Using Crypto Signals with Gravestone Doji Patterns

To enhance your crypto trading strategy, you can incorporate Doji patterns alongside crypto signals. Crypto signals, which are typically generated by experienced traders or automated algorithms, provide traders with insights into potential entry and exit points in the market.

Here’s how you can use crypto signals in combination with Gravestone Doji patterns:

- Confirming Reversals: When you receive a crypto signal suggesting a potential trade opportunity, examine the corresponding cryptocurrency’s chart for the presence of a Gravestone Doji. If you spot a Doji after a prolonged uptrend, it can reinforce the idea that a trend reversal may be imminent.

- Risk Management: Implement risk management strategies, such as setting stop-loss orders, to protect your capital in case the trade doesn’t go as expected. Combining the bearish signal of a Gravestone Doji with proper risk management is crucial.

- Time Frame Considerations: Be mindful of the time frame you are trading on. Gravestone Doji patterns can appear on various time frames, from minutes to daily charts. Adjust your trading strategy and risk management based on your chosen time frame.

Conclusion

In the world of crypto trading, where market sentiment can shift rapidly, traders need reliable tools and strategies to navigate the complexities of the market. The Gravestone Doji candlestick pattern, with its potential to signal trend reversals, can be a valuable addition to your trading arsenal.

By incorporating Doji patterns with crypto signals, traders can make more informed and confident trading decisions, leading to improved risk management and potentially more profitable trades. However, it’s important to remember that no single indicator or pattern guarantees success, and comprehensive analysis and risk management remain essential for successful trading in the dynamic crypto market.

Unlocking Market Insights with the Gravestone Doji Candlestick Pattern in Crypto Trading

Introduction

In the fast-paced world of cryptocurrency trading, traders are always on the hunt for tools and strategies to navigate the volatility and uncertainty. One such tool that has gained prominence is the Doji candlestick pattern. In this article, we will explore the Doji, its significance in crypto trading, and how it can complement crypto signals to empower traders with valuable insights for their trading decisions.

Understanding the Gravestone Doji Candlestick Pattern

The Doji is a single-candle pattern characterized by a small body and a long upper shadow that resembles a gravestone. It forms when the open, close, and low prices are all near the session’s low, while the high price creates a long upper shadow. Key elements of the Doji include:

- Small Body: The opening and closing prices are typically close to the session’s low, resulting in a small or non-existent body.

- Long Upper Shadow: The upper shadow represents the high price reached during the session, and it can extend significantly above the body.

- No or Tiny Lower Shadow: The lower shadow is either non-existent or very short, indicating minimal buying pressure during the session.

Significance in Crypto Trading

The Gravestone Doji is considered a bearish reversal pattern and can provide traders with essential insights into market sentiment. It typically appears after an uptrend and suggests a potential trend reversal from bullish to bearish. Here’s why the Gravestone Doji is significant in crypto trading:

- Bearish Reversal Signal: The appearance of a Gravestone Doji after a prolonged uptrend signals that buyers attempted to push the price higher but failed, resulting in a rejection and potential shift in market sentiment.

- Resistance Level: The high point of the Gravestone Doji’s upper shadow can act as a resistance level, indicating that the cryptocurrency may have trouble surpassing that level in the near term.

- Profit-taking: The pattern often indicates profit-taking by traders who were previously long on the cryptocurrency, contributing to the bearish sentiment.

Using Crypto Signals with Gravestone Doji Patterns

Integrating the Gravestone Doji pattern with crypto signals can be a powerful strategy to enhance your trading decisions. Crypto signals, which provide insights into potential entry and exit points, can be effectively used in conjunction with the Gravestone Doji pattern in the following ways:

- Confirmation of Bearish Signals: When you receive a crypto signal suggesting a potential short or sell opportunity, look for a Gravestone Doji on the corresponding cryptocurrency’s chart. If you find one after an uptrend, it can serve as a confirming signal for the bearish sentiment.

- Risk Management: Combine the Gravestone Doji’s bearish signal with risk management techniques like setting stop-loss orders. This helps protect your capital in case the trade doesn’t unfold as expected.

- Time Frame Considerations: Be aware of the time frame you are trading on, as Gravestone Doji patterns can appear on various time frames. Adjust your trading strategy and risk management based on your chosen time frame.

Conclusion

In the unpredictable world of cryptocurrency trading, traders are continually seeking reliable tools to make informed decisions. The Gravestone Doji candlestick pattern, with its potential to signal bearish reversals, can be a valuable addition to a trader’s toolkit.

When used in conjunction with crypto signals, traders can gain added confidence in their trading strategies, leading to better risk management and potentially more profitable trades. However, it’s crucial to remember that no single indicator or pattern guarantees success, and thorough analysis and risk management are essential for successful trading in the dynamic crypto market.