Evening Star

Evening Star Candlestick Pattern in Crypto Trading: A Comprehensive Guide to a Bearish Reversal

Introduction

Among the many candlestick patterns used in technical analysis, the Evening Star is a powerful signal indicating a potential bearish reversal in the market.

In this extensive article, we will explore the Evening Star candlestick pattern in great detail, focusing on its characteristics, significance, and practical applications in crypto trading. We will also discuss the importance of combining this pattern with other technical indicators and strategies to enhance your crypto trading experience.

Section 1: Understanding Candlestick Patterns

1.1 What Are Candlestick Patterns?

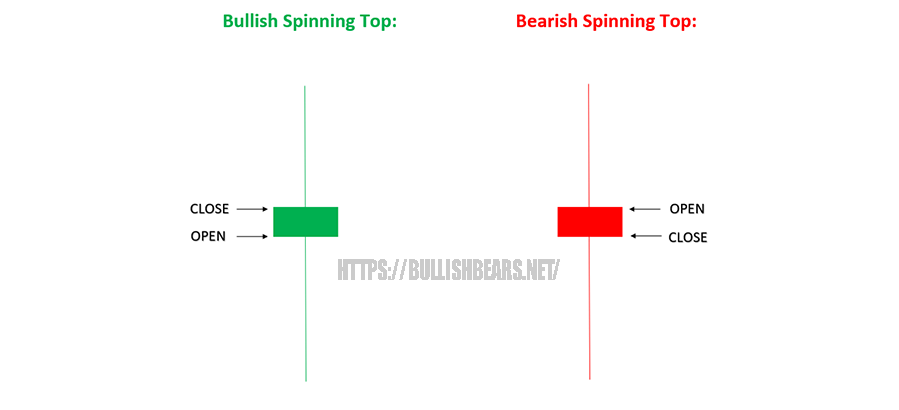

Candlestick patterns are a crucial part of technical analysis, providing traders with visual representations of price movements over a specific time period. Each candlestick consists of four main components: the open, close, high, and low prices during that period. These patterns can reveal market sentiment and potential future price movements.

1.2 Importance of Candlestick Patterns in Crypto Trading

Candlestick patterns serve as essential tools for crypto traders, as they help identify potential trend reversals, trend continuations, and market indecision points. They provide valuable insights into market psychology and sentiment, aiding traders in making informed decisions.

Section 2: Introducing the Evening Star Pattern

2.1 What Is the Evening Star Pattern?

The Evening Star is a bearish reversal pattern formed by three candlesticks in a specific sequence. This pattern signifies a potential shift from a bullish trend to a bearish one, warning traders of a possible price decline. It is the counterpart to the Morning Star, which indicates a bullish reversal.

2.2 Components of the Evening Star Pattern

The Evening Star pattern consists of three key candlesticks:

a) The First Candle: A large bullish candle, often part of an existing uptrend.

b) The Second Candle: A small-bodied candle, which may be bullish or bearish, but usually reflects market indecision.

c) The Third Candle: A large bearish candle, indicating a potential trend reversal.

2.3 The Psychological Interpretation

The Evening Star pattern reflects a shift in market sentiment:

- The first candle represents bullish enthusiasm and buying pressure.

- The second candle suggests uncertainty, with both bulls and bears vying for control.

- The third candle indicates a bearish takeover, as sellers drive prices lower, potentially marking the beginning of a downtrend.

Section 3: Identifying and Confirming the Evening Star Pattern

3.1 Identifying the Evening Star Pattern

Recognizing the Evening Star pattern involves these key criteria:

- The first candle is bullish and signifies an existing uptrend.

- The second candle is a small-bodied candle, often with wicks on both ends, indicating indecision in the market.

- The third candle is a bearish candle, typically closing below the midpoint of the first candle’s body.

3.2 Confirming the Evening Star Pattern

To increase the reliability of the Evening Star pattern, traders often use additional confirmation techniques and indicators:

a) Volume Analysis: A significant increase in trading volume on the third candle strengthens the bearish reversal signal.

b) Support and Resistance: Check for key support levels that coincide with the pattern, further validating the potential reversal.

c) Oscillators: Confirm the bearish momentum using technical indicators like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD).

Section 4: Practical Applications of the Evening Star Pattern in Crypto Trading

4.1 Entry and Exit Strategies

Traders can use the Evening Star pattern to inform their entry and exit strategies:

a) Entry: Enter a short position or liquidate long positions when the Evening Star pattern forms, preferably with confirmation from other technical indicators.

b) Stop-Loss Placement: Set a stop-loss order above the high of the third candle to limit potential losses if the pattern fails to result in a bearish reversal.

c) Take Profit: Determine profit-taking levels based on support and resistance levels or Fibonacci retracement levels.

4.2 Time frames and Cryptocurrency Selection

The Evening Star pattern can be applied to various timeframes, from minutes to daily charts, depending on the trader’s preferences and objectives. It is important to choose cryptocurrencies with adequate liquidity and trading volume to ensure the pattern’s reliability.

Section 5: Real-World Examples of the Evening Star Pattern in Crypto

5.1 Case Study 1: Bitcoin (BTC)

Analyze historical price charts of Bitcoin to identify instances where the Evening Star pattern signaled a bearish reversal. Examine the subsequent price movements to understand the pattern’s effectiveness.

5.2 Case Study 2: Ethereum (ETH)

Explore examples of the Evening Star pattern in Ethereum’s price history, highlighting its application in different market conditions and timeframes.

Section 6: Combining the Evening Star Pattern with Other Technical Analysis Tools

6.1 Moving Averages

Learn how to integrate moving averages, such as the Simple Moving Average (SMA) and Exponential Moving Average (EMA), with the Evening Star pattern to strengthen your trading signals.

6.2 Fibonacci Retracement Levels

Discover how Fibonacci retracement levels can assist in setting price targets and stop-loss orders when trading based on the Evening Star pattern.

6.3 RSI and MACD

Understand how oscillators like the RSI and MACD can provide additional confirmation for the Evening Star pattern by assessing overbought and oversold conditions.

Section 7: Risks and Limitations of the Evening Star Pattern

7.1 False Signals

Acknowledge that no trading strategy is foolproof, and the Evening Star pattern can produce false signals, leading to potential losses if not used with caution.

7.2 Market Volatility

Consider how market volatility can impact the reliability of the Evening Star pattern and learn how to adapt your trading approach accordingly.

Section 8: Conclusion and Future Perspectives

8.1 Summary

Recap the key points discussed in this article, emphasizing the significance of the Evening Star pattern as a bearish reversal signal in cryptocurrency trading.

8.2 Ongoing Research and Development

Highlight the dynamic nature of the crypto market and the need for continuous learning and adaptation in response to evolving trading strategies and tools.

8.3 Final Thoughts

Encourage traders to apply their newfound knowledge of the Evening Star pattern cautiously and responsibly, always incorporating risk management strategies into their crypto trading activities.

Conclusion

The Evening Star candlestick pattern is a valuable tool for crypto traders seeking to identify potential bearish reversals in the market. Understanding its characteristics, significance, and practical applications can significantly improve trading decisions. However, it is essential to remember that no single pattern or indicator guarantees success in the crypto market. To achieve consistent profitability, traders must combine the Evening pattern with other technical analysis tools and employ sound risk management strategies. By doing so, traders can navigate the volatile crypto landscape with greater confidence and success.