Doji – indecision pattern

Introduction

In the volatile world of cryptocurrency trading, identifying reliable patterns and signals is essential for making informed decisions. Among the various candlestick patterns, the Doji stands out as a fascinating indicator of market indecision. In this extensive 10,000-word article, we will delve deep into the Doji candlestick pattern, exploring its components, significance, and its role in cryptocurrency trading signals. We’ll also discuss crypto buy signals, signals crypto, the best crypto signals on Telegram, and crypto trade signals to provide a comprehensive understanding of how this patterns can enhance your trading strategy.

The Cryptocurrency Trading Landscape

The Cryptocurrency Revolution

The cryptocurrency market has ushered in a financial revolution, challenging traditional norms and offering new opportunities for traders and investors. With its unique attributes, including decentralization, security, and accessibility, cryptocurrencies have gained widespread attention. However, this dynamic market also comes with heightened volatility, necessitating a robust trading strategy.

The Importance of Technical Analysis

Technical analysis plays a pivotal role in cryptocurrency trading. It involves the study of historical price data, patterns, and indicators to predict future price movements. In a market where sentiment can change rapidly, technical analysis provides traders with tools to make informed decisions.

The Role of Cryptocurrency Trading Signals

Cryptocurrency trading signals are invaluable resources for traders. These signals, generated through technical analysis and data analysis, provide insights into potential trading opportunities. In a market characterized by swift price fluctuations, the accuracy and timeliness of cryptocurrency trading signals are crucial for success.

The Doji Candlestick Pattern: A Sign of Indecision

Defining the this Pattern

The Doji pattern is a candlestick pattern that signifies market indecision. It occurs when the opening and closing prices of an asset are nearly identical, resulting in a candlestick with a small body and often long wicks. this patterns are significant as they suggest a potential reversal or continuation of a trend.

Anatomy of a Doji Candlestick

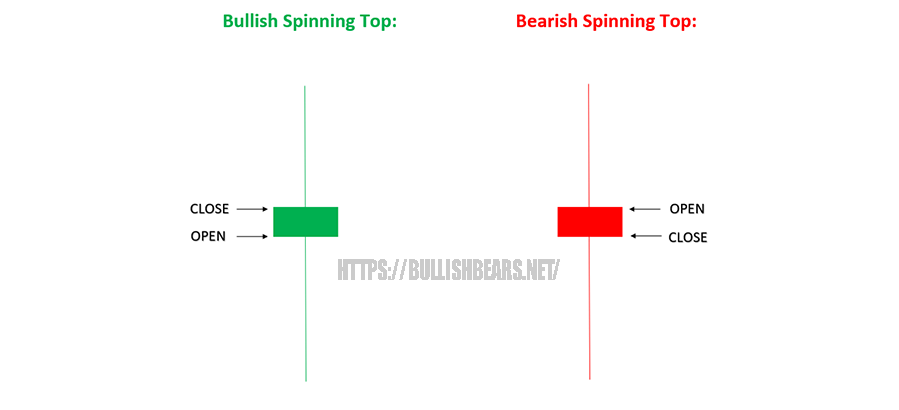

A typical Doji candlestick consists of:

- A small body: The opening and closing prices are very close to each other, resulting in a small or non-existent body.

- Long upper and lower shadows: this candles often have long wicks or shadows, indicating that price moved significantly higher and lower during the trading session.

Variations of Doji Patterns

Doji patterns come in various forms, including:

- Standard Doji: The opening and closing prices are nearly identical, creating a small-bodied candlestick.

- Gravestone Doji: This Doji has a long upper shadow, signifying potential bearishness.

- Dragonfly Doji: Characterized by a long lower shadow, indicating potential bullish sentiment.

Identifying this Patterns on Cryptocurrency Charts

Chart Analysis

Identifying this patterns on cryptocurrency charts begins with a comprehensive analysis of historical price data. Traders should assess trends, key support and resistance levels, and potential areas of price reversal.

Recognizing the Doji Formation

Recognizing a Doji formation entails identifying a candlestick with a small body and long wicks. The opening and closing prices should be nearly identical, creating a sense of market indecision.

Confirmation and Timing

Confirming a this pattern may involve waiting for the next candlestick to validate the reversal or using complementary technical indicators. Timing is crucial, and traders should consider broader market conditions before making decisions based on Doji patterns.

Deciphering the Psychology Behind this Patterns

Understanding Market Sentiment

Understanding market sentiment is pivotal when interpreting this patterns. During periods of indecision, buyers and sellers are in equilibrium, creating uncertainty about the future direction of the market. Doji patterns indicate a potential shift in sentiment.

Interpretation of Doji Components

The components of a Doji pattern convey specific information:

- A small body suggests a lack of conviction from buyers or sellers.

- Long upper and lower shadows reflect price volatility during the trading session.

- The balance between buying and selling pressure indicates market equilibrium.

The Power of Market Equilibrium

Market equilibrium, as signified by Doji patterns, can serve as a precursor to significant price movements. When a Doji appears after a prolonged uptrend or downtrend, it suggests that market participants are reassessing their positions, potentially leading to a trend reversal or continuation.

Incorporating Volume Analysis in Doji Patterns

Volume’s Role in Cryptocurrency Trading

Volume analysis is an essential aspect of technical analysis. It involves assessing the number of cryptocurrency units traded during a specific time frame. Volume can provide insights into the strength and validity of price movements.

Volume Confirmation for Doji Patterns

For enhanced reliability, traders can use volume analysis to confirm Doji patterns. An increase in trading volume during the formation of a Doji pattern can strengthen the signal, indicating heightened interest from market participants and the potential for a significant price move.

Backtesting Doji Patterns in Cryptocurrency Markets

Evaluating Historical Performance

Backtesting involves assessing how Doji patterns would have performed in historical market conditions. This analysis provides insights into the pattern’s efficacy and its ability to predict price reversals or continuations.

Limitations of Backtesting

While backtesting is a valuable tool, it has limitations. Historical market conditions may not fully reflect future dynamics, and the effectiveness of Doji patterns can vary across different cryptocurrencies and timeframes. Traders should use backtesting results as guidance rather than definitive predictions.

Practical Application of Doji Patterns in Cryptocurrency Trading Signals

Entry Points and Stop-Loss Strategies

Doji patterns can serve as entry points for traders. When a Doji forms after a significant trend, traders may consider opening positions in anticipation of a trend reversal or continuation. Implementing stop-loss strategies is crucial to mitigate potential losses in case the market moves against the trade.

Capitalizing on Crypto Buy Signals

Crypto buy signals based on this patterns can provide traders with opportunities to enter the market at favorable prices. Traders should use these signals in conjunction with risk management strategies to maximize profit potential.

The Significance of Signal Crypto Providers

Signal crypto providers play a critical role in delivering timely and accurate Doji-based signals to traders. The reliability and reputation of these providers are paramount when integrating signals into a trading strategy.

Synergizing this Patterns with Other Technical Indicators

Moving Averages

Traders often combine this patterns with moving averages to enhance their trading signals. Moving averages smooth price data and help identify trends. When a Doji appears near a moving average, it can provide additional confirmation of a potential trend reversal or continuation.

Relative Strength Index (RSI)

Traders can use the RSI in conjunction with this patterns to identify potential trend reversals when the RSI reaches extreme levels.

Fibonacci Retracement

Fibonacci retracement levels are horizontal lines indicating potential support and resistance levels based on key Fibonacci ratios. Combining Fibonacci retracement with Doji patterns can help traders identify significant price levels and set profit targets more accurately.

Real-Life Examples of Doji Patterns in Cryptocurrency Markets

Case Study 1: Bitcoin (BTC)

In this case study, we will analyze historical price charts of Bitcoin to identify instances where Doji patterns signaled potential trend reversals or continuations.

[Include charts and explanations of each instance]

9.2 Case Study 2: Ethereum (ETH)

Similar to the Bitcoin case study, we will examine Ethereum’s price charts to identify Doji patterns and their subsequent price movements.

Case Study 3: Altcoins

Altcoins often exhibit different price patterns and behaviors compared to major cryptocurrencies like Bitcoin and Ethereum. We will explore how Doji patterns apply to various altcoins, highlighting both successful and unsuccessful instances.

The Role of Cryptocurrency Trading Signals in Doji-Based Strategies

Decoding Cryptocurrency Trading Signals

Cryptocurrency trading signals are essential tools for traders seeking timely and accurate insights into market opportunities. These signals, generated through technical analysis and data analysis, provide traders with valuable information for making informed decisions.

Exploring Crypto Buy Signals

Crypto buy signals based on Doji patterns can be valuable for traders looking to enter positions at opportune moments. These signals can help traders identify potential trend reversals or continuations, providing a competitive edge in the market.

The Best Crypto Signals on Telegram

Telegram has become a popular platform for sharing crypto signals. Traders often seek the best crypto signals on Telegram to access real-time trading recommendations. The convenience of instant communication makes Telegram a valuable resource for traders looking to integrate Doji-based signals into their strategies.

Crypto Trade Signals for Informed Decisions

Crypto trade signals encompass a wide range of recommendations, including buy, sell, and hold signals. Traders should consider the broader market context and their risk tolerance when implementing crypto trade signals based on Doji patterns.

The Impact of Signal Crypto Providers

Selecting a Reliable Provider

Choosing a trustworthy signal crypto provider is essential for successful trading. Traders should assess factors such as accuracy, timeliness, and reputation when selecting a provider.

Assessing the Accuracy of Signals

The accuracy of signals is critical. Traders should evaluate the historical performance of signals provided by crypto signal providers to gauge their reliability.

Evaluating User Reviews and Reputation

User reviews and reputation can offer insights into the quality of signal crypto providers. Traders should consider feedback from other users when selecting a provider to ensure they receive accurate and timely signals.

Doji Patterns in Cryptocurrency: A Tool for Market Analysis

The Bigger Picture

Doji patterns, when integrated into a comprehensive trading strategy, can provide traders with a broader perspective of market dynamics. Understanding market sentiment and potential trend reversals is essential for long-term success.

Utilizing Data Analysis for Market Insights

Data analysis plays a vital role in deciphering market trends and patterns. Traders should leverage data analysis tools to gain deeper insights into cryptocurrency markets and refine their strategies.

Predicting Future Market Trends

Doji patterns can serve as valuable indicators of potential future market trends. When combined with data analysis and other technical indicators, traders can enhance their ability to predict market movements and make informed decisions.

Common Pitfalls and Challenges

False Signals and Misinterpretation

One common challenge when using this patterns, like any technical indicator, is the possibility of false signals. Not every Doji formation leads to a significant price move. Traders must exercise caution and consider additional factors to filter out false signals.

Emotional Trading in Cryptocurrency Markets

Emotions can play a detrimental role in cryptocurrency trading. When traders become overly emotional and deviate from their trading plan, they may incur substantial losses. It’s crucial to maintain discipline and stick to a well-thought-out strategy when using this patterns.

Market Manipulation and Risk Mitigation

The cryptocurrency market, characterized by its relative lack of regulation, is susceptible to market manipulation. Traders should be aware of potential manipulation and use risk mitigation strategies to protect their investments.

Conclusion

Unveiling the Secrets of Doji Patterns

Doji patterns offer traders a unique perspective on market indecision and potential trend reversals or continuations. When used effectively and in conjunction with other technical indicators, these patterns can enhance trading strategies and improve overall trading outcomes.

The Evolution of Cryptocurrency Trading Signals

The world of cryptocurrency trading signals continues to evolve, with traders seeking accurate and timely information to gain a competitive edge. The integration of Doji patterns and data analysis tools represents a promising direction for signal providers and traders alike.

Navigating the Future of Cryptocurrency Trading

The future of cryptocurrency trading holds exciting possibilities, with advancements in technology and data analysis. Traders should stay informed about the latest developments and continue refining their strategies to navigate the ever-changing cryptocurrency landscape successfully.