Introduction of World of Crypto Signals and Digital Investments

These signs, frequently produced by experienced brokers or robotized calculations, give bits of knowledge into potential market developments, helping both amateur and prepared financial backers in their dynamic cycles. In this article, we dive into the universe of crypto signals, investigating what they are, the way they work, their sorts, and the difficulties related with depending on them.

Grasping Crypto Signals

Crypto signals are basically pointers or prompts that propose potential cost developments, purchase/sell proposals, and market patterns in the digital currency space. These signs can be produced by human investigators who have a profound comprehension of the market elements or by refined calculations that use verifiable information and specialized examination.

The essential target of these signs is to furnish brokers with significant experiences that can assist them with settling on informed conclusions about when to enter or leave an exchange. By following up on well-informed and dissected signals, financial backers mean to boost benefits and limit misfortunes in a market that can change definitely in no time.

How Crypto Signals Work

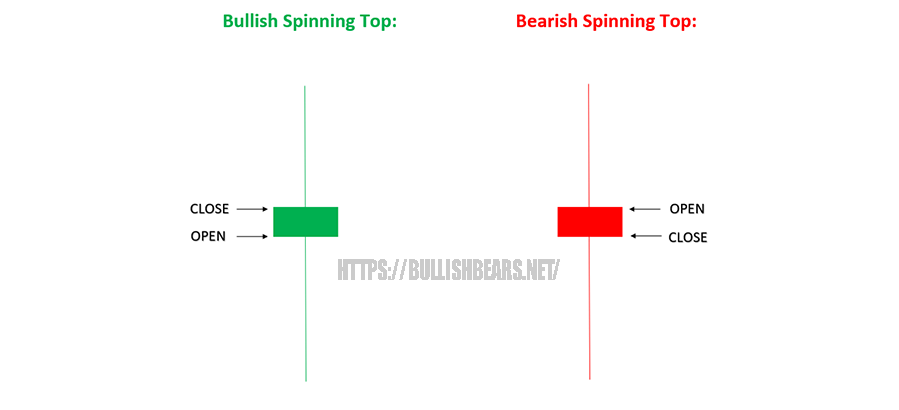

Crypto signals are often based on a combination of technical analysis, fundamental analysis, and market sentiment. Technical analysis involves studying past price patterns, chart trends, and various technical indicators like moving averages, relative strength index (RSI), and more. Fundamental analysis, on the other hand, considers external factors such as news events, regulatory changes, and technological developments that could influence the market.

Once the necessary data is collected and analyzed, analysts or algorithms generate signals that suggest potential market movements. These signals are then shared with subscribers through various communication channels such as social media platforms, messaging apps, email newsletters, and dedicated signal provider websites.

Types of Crypto Signals

Buy/Sell Signals: These are the most common types of signals, providing recommendations on whether to buy or sell a particular cryptocurrency. Buy signals indicate a potentially favorable market condition to purchase, while sell signals suggest a good time to offload a holding.

Long haul and Transient Signs: Signs can likewise be sorted in light of the time skyline they target. Long haul signals are expected for financial backers seeking hold resources for a drawn out period, while momentary signs take special care of merchants looking to benefit from fast cost developments throughout more limited time spans.

Risk Management Signals: In addition to buy/sell recommendations, some signal providers also offer risk management signals. These signals advise on setting stop-loss and take-profit levels, helping investors protect their capital and secure profits.

Challenges and Risks(crypto signals telegram groups)

While crypto signals offer a promising approach to navigate the complex cryptocurrency market, there are notable challenges and risks associated with their usage:

Accuracy: No signal is foolproof, and relying solely on signals can lead to poor investment decisions.

Dependency: Relying solely on signals can hinder the development of a trader’s analytical skills. It’s important for traders to understand the reasoning behind signals and learn from them.

Scams and Manipulation: The crypto Signals space has seen its fair share of scams and fraudulent signal providers. Traders must exercise caution and verify the legitimacy of signal sources before acting on them.

Conclusion cryptocurrency fat pig signals

Crypto signals have emerged as valuable tools in the world of digital investments, providing traders and investors with insights that can guide their decision-making processes. These signals, generated through a blend of technical analysis, fundamental analysis, and market sentiment, offer recommendations on buy/sell actions and risk management strategies. However, it’s important to approach these signals with caution, understanding their limitations and the inherent risks associated with trading in the highly volatile cryptocurrency market. While signals can serve as valuable resources, they should ideally complement a trader’s broader understanding of the market rather than replace it entirely.

telegram channels for crypto signals

Introduction

The advancement of monetary business sectors has been radically changed by the coming of digital forms of money. These computerized resources have caught the creative mind of tech fans as well as turned into a huge player in the speculation scene. With the ascent of digital currencies, another market has arisen – one that works day in and day out and is profoundly unstable. In this high speed climate, dealers are progressively depending on apparatuses, for example, cryptographic money exchanging signs to explore the mind boggling universe of advanced resources. Among the numerous suppliers, BullishBears has earned consideration for its bits of knowledge and systems. This article dives into the universe of cryptographic money exchanging signals and investigates how stages like BullishBears are forming the manner in which dealers approach the computerized market.

Digital money Exchanging Signs: A Preliminary

Digital money exchanging signals are, generally, proposals or ideas given by investigators, dealers, or mechanized frameworks that offer bits of knowledge into potential exchanging open doors. These signs incorporate data, for example, when to purchase, sell, or hold a specific cryptographic money, alongside the explanations for these suggestions. In the unpredictable crypto Signals market, where costs can swing stunningly right away, approaching opportune and very much educated exchanging signs can have a significant effect.

Understanding BullishBears

BullishBears is a notable player in the field of cryptocurrency trading signals. It’s an online community and platform that offers a range of resources to help traders make informed decisions. One of the standout features of BullishBears is its emphasis on education. The platform provides tutorials, webinars, and articles that empower traders with the knowledge they need to understand the market dynamics and make sound decisions.

The Role of Cryptocurrency Trading Signals

- Risk Mitigation: The cryptocurrency market is notorious for its high volatility. Trading signals can help traders identify potential entry and exit points, reducing the risk associated with emotional decision-making.

- Diversification: Cryptocurrency trading signals cover a wide range of assets. This enables traders to diversify their portfolios beyond the popular Bitcoin and Ethereum.

Types of Crypto Signals

- Technical Analysis Signals: These signals are based on chart patterns, indicators, and other technical tools that help predict price movements. Technical analysis signals are particularly popular in the crypto Signals due to its speculative nature.

- Fundamental Analysis Signals: These signals are rooted in the fundamental aspects of a cryptocurrency, such as its technology, partnerships, and market trends. Fundamental analysis signals are essential for long-term investors.

- Sentiment Analysis Signals: Sentiment analysis involves gauging the market’s mood through social media posts, news articles, and other sources. It’s a more unconventional approach but can provide unique insights.

BullishBears‘ Approach to Crypto Signals

BullishBears offers a comprehensive approach to crypto signals, catering to both beginners and experienced traders. The platform combines technical and fundamental analysis, along with real-time market sentiment, to provide a holistic view of the market. Additionally, BullishBears‘ educational resources ensure that traders have the tools to understand and interpret the signals effectively.

Challenges and Considerations

While crypto signals can be invaluable, there are challenges to consider:

- Reliability: Not all signals are accurate, and false signals can lead to significant losses. Traders need to be cautious and verify signals with their own analysis.

- Market Volatility: Cryptocurrency markets can be highly unpredictable. Even the most accurate signals might not account for sudden and extreme market fluctuations.

- Over dependence: Relying solely on trading signals without understanding the market can hinder a trader’s growth. It’s crucial to use signals as a tool for informed decision-making rather than blindly following recommendations.