Bullish Harami Chart Patterns

Cryptocurrency trading has gained unprecedented popularity, attracting traders from diverse backgrounds to the world of digital assets. In the realm of crypto trading, understanding chart patterns and signals is essential for making informed decisions and maximizing profits. Among the arsenal of technical analysis tools, the Bullish Harami chart pattern stands out as a powerful indicator. This comprehensive guide explores the intricacies of Bullish Harami patterns, their relevance in the crypto market, and the role of platforms offering Crypto Signals Free, Altcoin Signals, Crypto Signals Live, and Cryptocurrency Trading Signals.

Cryptocurrency trading has transcended geographical boundaries, becoming a global phenomenon that reshapes traditional finance. With Bitcoin leading the charge, a myriad of cryptocurrencies now offer new avenues for investment and trading opportunities.

1. The Significance of Trading Signals

In the volatile world of cryptocurrencies, trading signals play a vital role in helping traders navigate the complex market. These signals offer insights into potential price movements, enabling traders to make informed decisions amidst the rapid fluctuations that characterize the crypto landscape.

2. Decoding Chart Patterns in Crypto Trading

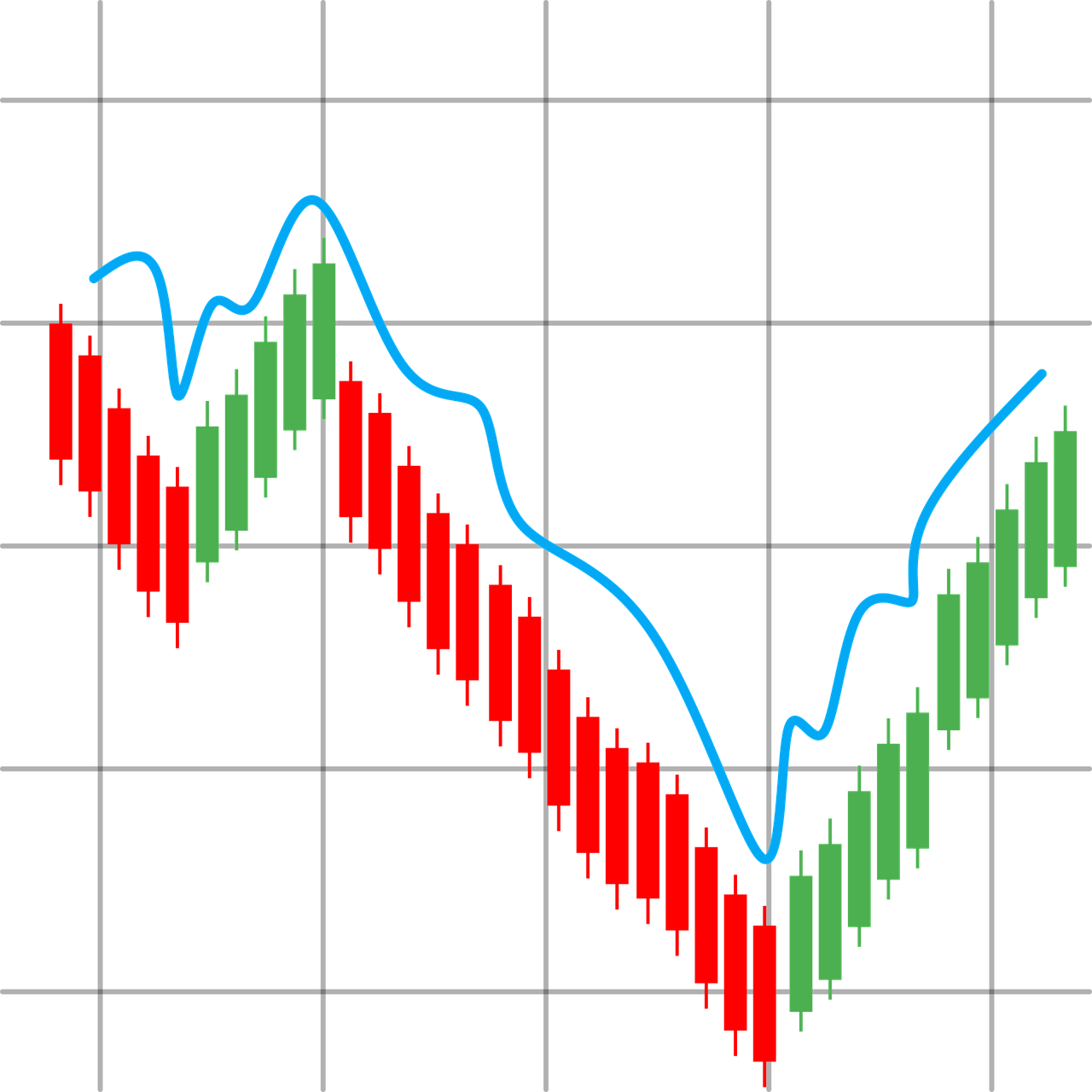

The Art of Reading Candlestick Charts

Candlestick charts are a staple of technical analysis, visually representing price movements over a specific period. Each candlestick comprises four key elements: opening price, closing price, highest price, and lowest price. These elements form the basis of patterns and trends in chart analysis.

Harnessing Patterns for Informed Trading

Chart patterns provide traders with valuable information about market trends and potential reversals. These patterns can be categorized as bullish Harami (indicating upward movement) or bearish (indicating downward movement). Among these, the Bullish Harami pattern emerges as a powerful signal for traders seeking buying opportunities.

3. Unveiling the Bullish Harami Pattern

Understanding Bullish Harami and Bearish Harami

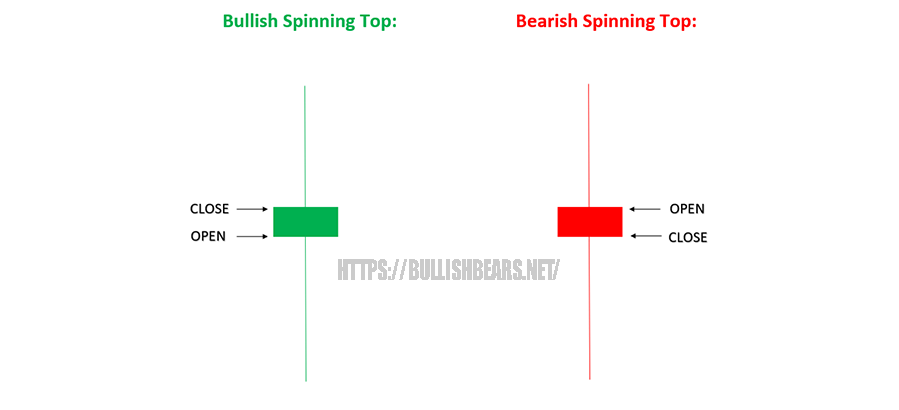

The concept of “harami” in candlestick patterns refers to a smaller candlestick within the range of a larger candlestick. A Bullish Harami pattern forms after a downtrend and consists of a small bearish candlestick followed by a larger bullish Harami candlestick.

Identifying the Components of a Bullish Harami Pattern

A Bullish Harami pattern comprises two candlesticks. The first candlestick is bearish and reflects prevailing selling pressure. The second candlestick is smaller, bullish, and completely contained within the range of the first candlestick. This pattern indicates a potential reversal of the downtrend.

Psychological Insights Behind the Pattern

The Bullish Harami pattern symbolizes a shift in market sentiment. The initial bearish candlestick signals ongoing selling pressure and a prevailing downtrend. However, the subsequent smaller bullish Harami candlestick suggests a weakening of selling pressure and the emergence of buying interest, potentially leading to an upward reversal.

4. Leveraging Bullish Harami Patterns in Crypto Trading

Volatility in the Crypto Market

Cryptocurrency markets are renowned for their volatility, which offers both opportunities and risks. While significant price swings can result in substantial gains, they also expose traders to potential losses. The Bullish Harami pattern serves as a valuable tool for traders navigating this volatility by identifying potential trend reversals.

The Timely Nature of Crypto Trading

Cryptocurrency markets operate 24/7, providing continuous trading opportunities. The Bullish Harami pattern’s significance transcends different timeframes, catering to various trading styles, from day trading to longer-term strategies. Traders can identify and act upon Bullish Harami patterns across different timeframes based on their preferred approach.

Risk Management and Capital Protection

Effective risk management remains a cornerstone of successful trading. Traders must establish appropriate stop-loss levels, manage position sizes, and adhere to disciplined trading strategies. The appearance of a Bullish Harami pattern prompts traders to consider tighter stop-loss orders to protect gains and minimize losses during potential trend reversals.

5. Exploring the Landscape of Crypto Signals

The Power of Crypto Signals

Trading signals serve as essential tools for traders seeking to navigate the dynamic crypto market. These signals provide insights into potential entry and exit points, helping traders make well-informed decisions based on analysis and market trends.

Diverse Types of Trading Signals

Crypto signals come in various forms, including technical signals, fundamental signals, and sentiment-based signals. Technical signals involve analyzing price charts and patterns, while fundamental signals consider underlying factors such as news and events. Sentiment-based signals gauge market sentiment through social media and news analysis.

Incorporating Bullish Harami Patterns in Signals

Signal providers, including those offering Crypto Signals Free, Altcoin Signals, Crypto Signals Live, and Cryptocurrency Trading Signals, can integrate Bullish Harami patterns into their analysis. Recognizing the pattern’s potential for trend reversals, signal providers offer traders insights that help refine their strategies and capitalize on buying opportunities.

6. Crypto Signals Free: Empowering Traders with Insights

The Attraction of Free Signals

Crypto Signals Free platforms appeal to traders seeking insights without financial commitments. These platforms offer valuable analysis and recommendations, making them accessible to traders of varying experience levels.

The Role of Bullish Harami Patterns in Free Signals

Traders utilizing Crypto Signals Free platforms can benefit from the insights provided by the Bullish Harami pattern. By identifying this pattern in free signals, traders can assess potential buying opportunities and factor this information into their trading decisions. However, additional analysis and validation are recommended to confirm the pattern’s validity.

Evaluating the Accuracy of Free Signals

Traders should exercise caution when relying solely on free signals, as their accuracy and reliability may vary. It’s essential to assess the signal provider’s track record, consider their analysis methods, and cross-reference with other indicators before making trading decisions.

7. Altcoin Signals: Navigating the Diverse Crypto Landscape

Focusing on Altcoins with Altcoin Signals

Altcoin Signals platforms cater to traders interested in alternative cryptocurrencies to Bitcoin. These platforms offer insights into potential price movements of a wide range of altcoins, allowing traders to diversify their portfolios.

Identifying Bullish Harami Patterns in Altcoin Signals

The inclusion of Bullish Harami patterns in Altcoin Signals adds depth to the insights provided to traders. Traders can receive alerts and notifications when a Bullish Harami pattern emerges on specific altcoins, empowering them to evaluate potential upward reversals and consider adding these assets to their trading strategies.

Real-World Success Stories from Altcoin Signals

To illustrate the practical application of Bullish Harami patterns within Altcoin Signals, real-world success stories can be examined. By analyzing historical trades where the pattern was identified in signals, traders can gain insights into the pattern’s accuracy in predicting potential buying opportunities.

8. Crypto Signals Live: Real-Time Trading Advantage

The Dynamics of Real-Time Crypto Signals

Crypto Signals Live platforms offer real-time insights into the cryptocurrency market. The immediacy of these signals enables traders to capitalize on emerging opportunities swiftly, especially in a market known for its rapid price movements.

Recognizing Bullish Harami Patterns in Live Signals

Within Crypto Signals Live platforms, identifying Bullish Harami patterns holds substantial significance. Traders can receive immediate alerts when a Bullish Harami pattern emerges on specific cryptocurrencies, allowing them to assess the pattern’s context and make timely decisions.

Case Studies: Profiting from Live Bullish Harami Signals

To showcase the practical utility of Bullish Harami patterns within Crypto Signals Live platforms, case studies of successful trades can be examined. Analyzing historical trades where the pattern was identified in real-time signals provides insight into its potential effectiveness in predicting upward reversals.

9. Cryptocurrency Trading Signals: Insights for Market Mastery

Comprehensive Signals for Cryptocurrency Trading

Cryptocurrency Trading Signals platforms provide traders with comprehensive insights into the market. These platforms often combine technical analysis, fundamental analysis, and sentiment analysis to offer a holistic view of potential trading opportunities.

The Inclusion of Bullish Harami Patterns in Trading Signals

The Bullish Harami pattern’s inclusion in Cryptocurrency Trading Signals further enhances the value provided to traders. By recognizing the potential for trend reversals, these platforms offer traders a comprehensive perspective on potential buying opportunities.

Historical Performance Analysis

To assess the Bullish Harami pattern’s impact within Cryptocurrency Trading Signals, traders can analyze historical performance. This retrospective analysis provides insights into how accurately signals incorporating the pattern predicted actual price movements.

10. Strategies for Successful Trading

Confirmation with Technical Indicators

While Bullish Harami patterns offer valuable insights, traders often seek confirmation from other technical indicators. Indicators such as moving averages, relative strength index (RSI), and volume analysis can complement the pattern’s signals, providing additional context before making trading decisions.

Considering Trends and Market Context

Successful trading strategies consider broader market trends and sentiment. Traders should evaluate the overall market landscape and the specific cryptocurrency’s historical performance when incorporating Bullish Harami patterns into their trading strategies.

Implementing Risk Management Strategies

Effective risk management remains paramount. Traders should allocate capital wisely, avoid overleveraging, and establish appropriate stop-loss levels. Diversifying across various assets and trading strategies can help mitigate potential losses due to unexpected market movements.

11. The Future of Crypto Trading Signals

Technological Advancements and AI Integration

Advancements in technology, including artificial intelligence (AI) and machine learning, are likely to shape the future of crypto trading signals. Automation and data-driven insights could enhance signal accuracy and provide traders with real-time information powered by advanced algorithms.

Evolving Trading Strategies and Approaches

The cryptocurrency market is ever-evolving, influenced by technological advancements, regulatory changes, and shifts in market sentiment. Traders must remain adaptable, adjusting their strategies to align with changing market dynamics and the emergence of new trading patterns.

Regulatory Considerations for Signal Providers

As regulatory frameworks around cryptocurrencies continue to evolve, signal providers may need to adapt to new compliance requirements. Traders should stay informed about regulatory changes that could impact the availability and accuracy of trading signals.

12. Conclusion

The Fusion of Art and Science in Trading

Cryptocurrency trading is a dynamic blend of art and science. Successful traders combine technical analysis expertise, fundamental insights, and emotional discipline to navigate the complexities of the market.