Bullish Engulfing Candlestick Pattern

In the realm of technical analysis, candlestick patterns play a pivotal role in helping traders and investors make informed decisions. One such pattern that holds significant importance is the Bullish Engulfing Candlestick Pattern. This example is a strong sign of possible bullish energy on the lookout. In this article, we will investigate the Bullish Overwhelming Candle Example, its qualities, and the way in which brokers can actually integrate it into their exchanging procedures.

Understanding the Bullish Engulfing Candlestick Pattern

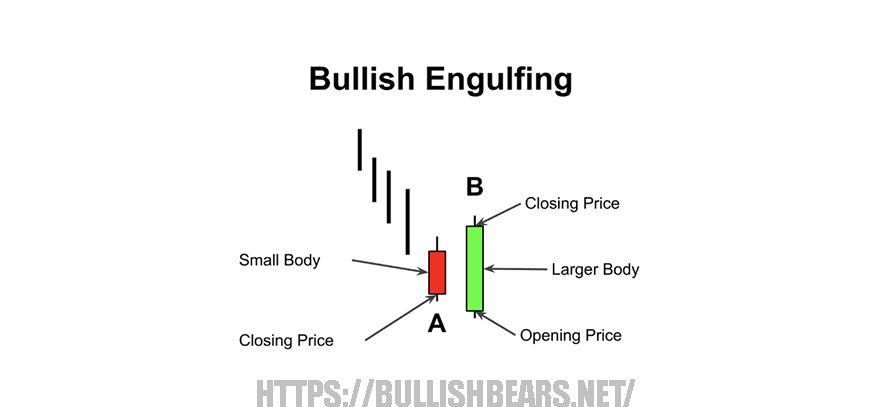

The Bullish Engulfing Candlestick Pattern is a two-candle reversal pattern that occurs at the end of a downtrend, signaling a potential shift towards a bullish trend. To identify this pattern, you need to look for the following characteristics:

- Prior Trend: The market should be in a clear downtrend before the Bullish Engulfing pattern appears.

- First Candle: The first candle is typically a bearish (downward) candle, indicating that the sellers are in control.

- Second Candle: The second candle is a bullish (upward) candle that completely engulfs the previous bearish candle. In other words, the second candle’s body should open below the first candle’s close and close above the first candle’s open.

Bullish Engulfing Candlestick Pattern

Significance of the Bullish Engulfing Candlestick Pattern

- Reversal Signal: The Bullish Engulfing Pattern is a strong reversal signal, suggesting that the bears are losing their grip on the market, and the bulls are taking over.

- Increased Buying Pressure: The pattern’s formation signifies an increase in buying pressure, often leading to higher prices in the subsequent periods.

- Confidence Booster: Traders and investors use this pattern to gain confidence in a potential trend reversal, helping them make more informed decisions.

Trading the Bullish Engulfing Candlestick Pattern

Trading the Bullish Engulfing Candlestick Pattern involves the following steps:

- Identify the Pattern: First, confirm that the pattern has formed correctly by ensuring the second candle completely engulfs the first one.

- Wait for Confirmation: Although the pattern is a strong signal by itself, it’s often wise to wait for confirmation through subsequent bullish price action.

- Entry Point: Consider entering a long (buy) position as soon as the bullish engulfing candle closes. Some traders may also wait for a slight pullback before entering.

- Stop-Loss and Take-Profit: Implement proper risk management by setting a stop-loss order to limit potential losses. Determine your take-profit levels based on your trading strategy and risk tolerance.

- Monitor the Trade: Keep a close eye on the market to adjust your position if necessary. Trailing stop-loss orders can be useful to lock in profits.

The Bullish Engulfing Candlestick Pattern is a two-candle pattern that typically appears at the end of a downtrend, signaling a potential reversal. It consists of two distinct candles:

- Bearish Candle (First Candle): The first candle is a bearish candle, indicating a period of selling pressure. This candle can be of various lengths and shapes, but it should represent a clear downturn in price.

- Bullish Candle (Second Candle): The second candle is a bullish candle that engulfs the preceding bearish candle. This means that the bullish candle’s body completely covers the body of the bearish candle, hence the name “engulfing.” The bullish candle is often larger and has a higher closing price than the bearish candle.

Key Characteristics of the Bullish Engulfing Pattern

- Reversal Signal: The primary purpose of the Bullish Engulfing Candlestick Pattern is to signify a potential reversal of the prevailing downtrend. When this pattern forms after a series of declining prices, it suggests that bullish sentiment may be gaining strength.

- Strong Bullish Momentum: The fact that the second candle completely engulfs the first one underscores the strength of bullish sentiment. It indicates that buyers have overwhelmed sellers during the formation of the second candle.

- Volume Confirmation: For a Bullish Engulfing Candlestick Pattern to be more reliable, it is often recommended to look for confirmation through trading volume. An increase in trading volume on the second (bullish) candle adds credibility to the pattern.

- Support and Resistance Levels: The pattern is most effective when it occurs near significant support levels, as this reinforces the potential for a reversal. Traders often use other technical analysis tools to identify these levels.

Trading Strategies with the Bullish Engulfing Pattern

- Entry Point: Traders can use the Bullish Engulfing Candlestick Pattern as an entry point for long positions. This means buying when the pattern forms and placing a stop-loss order below the low of the engulfing candle for risk management.

- Confirmation: To increase the reliability of the pattern, traders often wait for additional confirmation, such as a higher close on the following candle or other technical indicators like moving averages.

- Target Price: Traders can set a target price based on previous levels of resistance or by using other technical analysis tools. This helps in determining when to take profits.

- Risk Management: As with any trading strategy, it’s essential to implement proper risk management techniques, including setting stop-loss orders and position sizing.

Conclusion

The Bullish Engulfing Candle Example is a significant device in the stockpile of specialized examiners and brokers. It fills in as a reasonable sign of possible bullish energy after a downtrend and can assist brokers with pursuing very much educated choices. Be that as it may, similar to every single specialized design, it isn’t secure and ought to be utilized related to different types of examination to augment its adequacy. Whether you are a fledgling merchant or an accomplished financial backer, understanding and integrating the Bullish Overwhelming Candle Example into your exchanging technique can be a strong method for recognizing likely open doors on the lookout.