Technical analysis of Bearish engulfing bearish reversal pattern

The Ascent of Cryptographic money Exchanging

Lately, digital currencies have altered the monetary scene, offering new venture roads and reshaping customary exchanging rehearses. Bitcoin, presented in 2009 by the puzzling Satoshi Nakamoto, made ready for large number of elective digital currencies, each with its one of a kind highlights and applications. The potential for significant benefits and the charm of a decentralized computerized economy have brought brokers and financial backers into the universe of cryptographic money exchanging.

The Job of Exchanging Signs

Cryptographic money markets are infamous at their cost unpredictability, portrayed by fast and capricious cost developments. While this unpredictability can yield great additions, it likewise presents critical dangers. Exchanging signals act as critical instruments for brokers looking to explore this instability by giving experiences into potential market developments. As dealers endeavor to boost benefits and limit misfortunes, exchanging signals assume an essential part in informed navigation.

2. Candle Examples and Their Importance

The Language of Candle Outlines

Candle diagrams, a well known type of specialized examination, outwardly address cost developments over a predefined period. Every candle on the outline involves four basic pieces of information: the initial value, the end value, the greatest cost, and the most reduced cost. These information focuses structure the body and wicks of the candle, passing on significant data about market opinion and cost activity.

Using Examples for Informed Exchanging

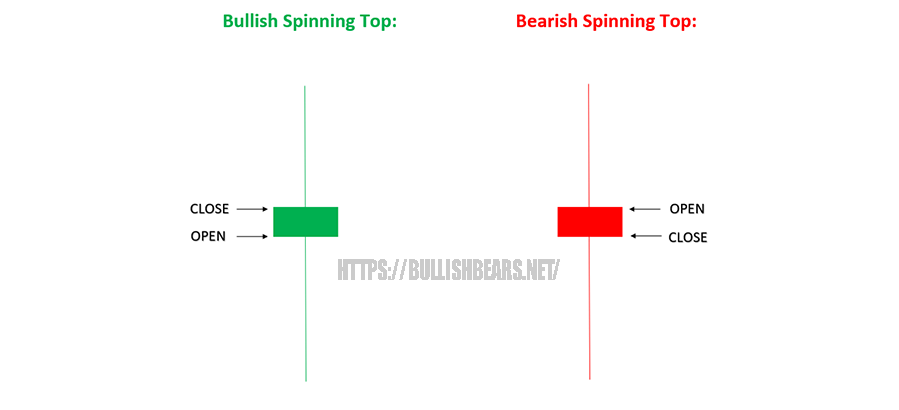

Candle designs are a foundation of specialized examination, offering bits of knowledge into potential market patterns and inversions. Examples can be comprehensively arranged as bullish (showing up cost development) or negative (demonstrating lower cost development). The Negative Overwhelming example falls into the last classification and is famous for its importance in flagging potential pattern inversions.

3. Disentangling the Negative Inundating Example

Grasping Negative and Bullish Inundating

The idea of “overwhelming” in candle designs alludes to one candle totally immersing the past candle. An overwhelming example is a two-candle design where the body of the subsequent light completely immerses the body of the main flame. While the inundating design happens after an upturn, it’s known as a Negative Immersing design, flagging an expected inversion of the pattern. On the other hand, when it happens after a downtrend, it’s known as a Bullish Overwhelming example, recommending an expected vertical inversion.

3. Decoding the Bearish Engulfing bearish reversal pattern

Understanding Bearish engulfing and Bullish Engulfing

The concept of “engulfing” in candlestick patterns refers to one candlestick completely engulfing the previous candlestick. An engulfing pattern is a two-candle pattern where the body of the second candle fully engulfs the body of the first candle. When the engulfing pattern occurs after an uptrend, it’s called a Bearish Engulfing bearish reversal pattern, signaling a potential reversal of the trend. Conversely, when it occurs after a downtrend, it’s called a Bullish Engulfing pattern, suggesting a potential upward reversal.

Identifying a Bearish Engulfing bearish reversal pattern

A Bearish Engulfing pattern comprises two candlesticks. The first candlestick is typically bullish (upward), followed by a larger bearish engulfing (downward) candlestick that engulfs the body of the first candlestick. The second candlestick’s body completely “engulfs” the body of the first, indicating a shift from buyer dominance to seller dominance.

Psychological Implications of the Pattern

The Bearish Engulfing pattern signifies a notable shift in market sentiment. The bullish candlestick reflects the initial optimism of buyers, suggesting an ongoing uptrend. However, the subsequent larger bearish engulfing candlestick represents a surge in selling pressure, overpowering the earlier bullish sentiment. This shift is often attributed to profit-taking by traders who bought during the uptrend and are now looking to secure gains before a potential downturn.

4. Applying Bearish Engulfing in Cryptocurrency Trading

Volatility in Cryptocurrency Markets

The cryptocurrency market is renowned for its heightened volatility, resulting in both opportunities and risks for traders. While substantial price swings can lead to considerable profits, they also expose traders to substantial losses. The Bearish Engulfing pattern can be a valuable tool for traders navigating this volatility, providing insights into potential trend reversals.

The Timely Nature of Cryptocurrency Trading

Cryptocurrency markets operate 24/7, offering continuous trading opportunities. The Bearish Engulfing pattern’s significance extends to different timeframes, from short-term day trading to longer-term position trading. Traders can identify and act upon Bearish Engulfing patterns on various timeframes, aligning with their preferred trading style.

Risk Management and Exit Strategies

Effective risk management is a cornerstone of successful trading, especially in the volatile cryptocurrency market. Traders must set appropriate stop-loss levels to mitigate potential losses in the event a trade goes against them. The Bearish Engulfing pattern’s emergence prompts traders to consider tighter stop-loss orders, safeguarding gains and minimizing losses during potential trend reversals.

5. Exploring Crypto Trading Signals

The Dynamics of Crypto Trading Signals

Crypto trading signals are insights or indicators that help traders make informed decisions in the market. These signals can be generated through technical analysis, fundamental analysis, or a combination of both. They aim to provide traders with potential entry and exit points, thereby enhancing the accuracy of their trading decisions.

Technical and Fundamental Signals

Technical signals are derived from analyzing price charts, patterns, and indicators. Fundamental signals, on the other hand, stem from the analysis of underlying factors that could impact an asset’s value, such as news, events, and market sentiment. Combining technical and fundamental signals can provide traders with a comprehensive view of the market.

Integrating Bearish Engulfing into Trading Signals

The Bearish Engulfing pattern’s appearance on a price chart can serve as a significant signal for traders. Crypto trading signals providers, such as Altsignals, Live Crypto Signals, Free Crypto Signals, and Best Crypto Signals, may incorporate the Bearish Engulfing bearish reversal pattern into their analysis. Traders can receive insights about potential trend reversals and use this information as a basis for their trading strategies.

6. A Glimpse into Altsignals: Leveraging the Pattern

Altsignals and Its Role in Crypto Trading

Altsignals is a prominent platform that offers cryptocurrency trading signals to its members. With a focus on altcoins (alternative cryptocurrencies to Bitcoin), Altsignals provides insights into potential price movements and market trends. Traders can benefit from the expertise of seasoned analysts and utilize these signals to refine their trading strategies.

Incorporating Bearish Engulfing in Altsignals

The Bearish Engulfing pattern’s significance aligns well with Altsignals’ offerings.

Analyzing Historical Performance

To assess the impact of the Bearish Engulfing bearish reversal pattern within the context of Altsignals’ signals, historical performance can be analyzed. Traders can study the accuracy of signals that incorporated the Bearish Engulfing pattern and evaluate how these signals aligned with actual price movements. This retrospective analysis provides insights into the pattern’s effectiveness within Altsignals’ signal framework.

7. Live Crypto Signals: Real-Time Insights bullish and bearish engulfing bearish reversal pattern

Live Crypto Signals’ Impact on Trading

Live Crypto Signals, as the name suggests, provides real-time insights into the cryptocurrency market. The immediacy of these signals enables traders to capitalize on emerging opportunities swiftly. For traders who value rapid decision-making, Live Crypto Signals offers a platform to receive timely information and make quick adjustments to their trading strategies.

Identifying Bearish Engulfing in Live Signals

Within the Live Crypto Signals ecosystem, the identification of Bearish Engulfing bearish reversal pattern holds significance. Traders can receive alerts and notifications when a Bearish Engulfing pattern emerges on specific cryptocurrencies. This real-time information empowers traders to assess the pattern’s context and make informed decisions promptly.

Case Studies: Successful Trades Using Live Crypto Signals

To showcase the practical application of the Bearish Engulfing bearish reversal pattern within Live Crypto Signals, case studies of successful trades can be examined. By analyzing historical trades where the pattern was identified in real-time signals, traders can gain insights into the pattern’s potential to forecast trend reversals accurately.

8. Free Crypto Signals: Opportunities and Risks and bearish engulfing signal

The Allure of Free Crypto Signals

Free Crypto Signals platforms cater to traders seeking trading insights without a financial commitment. While the appeal of cost-free signals is evident, traders must exercise caution when relying solely on free signals, as their accuracy and reliability may vary.

Utilizing Bearish Engulfing bearish reversal pattern in Free Signals

Traders utilizing Free Crypto Signals can benefit from the insights provided by the Bearish Engulfing bearish reversal pattern. By identifying this pattern in free signals, traders can gauge potential reversals and factor this information into their trading decisions. However, additional analysis and due diligence are recommended to confirm the pattern’s validity.

Navigating Risks and Ensuring Accuracy

Traders should approach free signals with a critical mindset. While some free signal providers offer valuable insights, others may lack transparency or accuracy. Thoroughly researching the signal provider, analyzing historical performance, and cross-referencing with other indicators can help mitigate risks associated with free signals.

9. The Best Crypto Signals: Quality Matters

Seeking Quality in Crypto Trading Signals

Traders seeking a more comprehensive and accurate signal experience often turn to premium platforms known for their quality and reliability. The Best Crypto Signals providers prioritize accuracy, expertise, and transparency, offering traders a premium service that aligns with their trading goals.

The Role of Bearish Engulfing in Premium Signals

In the realm of premium signals, the Bearish Engulfing bearish reversal pattern inclusion enhances the value proposition for traders. Premium signal providers recognize the pattern’s significance and incorporate it into their analysis, offering traders a holistic view of potential trend reversals.

Research and Due Diligence in Signal Selection

When selecting the best signal provider, traders should conduct thorough research and due diligence. Analyzing historical performance, evaluating the expertise of analysts, and assessing the provider’s communication and transparency are essential steps in making an informed decision.

10. Crafting Effective Trading Strategies

Confirmation with Technical Indicators

While the Bearish Engulfing bearish reversal pattern provides valuable insights, traders often combine it with other technical indicators to confirm potential reversals. Indicators such as the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Bollinger Bands can complement the pattern’s signals, offering additional context.

Factorial Analysis and Trend Considerations

Successful trading strategies consider multiple factors, including trend analysis, support and resistance levels, and broader market sentiment. Traders should factor in the overall market landscape and the specific cryptocurrency’s historical performance when incorporating the Bearish Engulfing bearish reversal pattern.

Risk Management and Diversification

Effective risk management remains paramount. Traders should allocate capital wisely, avoid overleveraging, and set appropriate stop-loss levels. Diversification across different assets and trading strategies can help mitigate potential losses stemming from unpredictable market movements.

11. Future Trends in Crypto Trading Signals

Technological Advancements and Automation

Advancements in technology, such as artificial intelligence (AI) and machine learning, are likely to impact the evolution of crypto trading signals. Automation could enhance signal accuracy and offer traders real-time insights powered by sophisticated algorithms.

Evolving Market Dynamics and Strategy Adaptation

The cryptocurrency market is continually evolving, influenced by factors such as technological developments, regulatory changes, and market sentiment shifts. Traders must remain adaptable, adjusting their strategies to align with changing market dynamics.

Regulatory Influences on Signal Providers

As governments and regulatory bodies globally refine their stance on cryptocurrencies, signal providers may need to navigate new compliance requirements. Traders should be aware of any regulatory shifts that could impact the availability and accuracy of trading signals.

12. Conclusion

The Art and Science of Trading

Cryptocurrency trading is both an art and a science. Successful traders blend technical expertise, analytical acumen, and emotional discipline to navigate the complexities of the market.