Bearish Harami Candlestick Pattern

Cryptographic money exchanging has acquired enormous prevalence late years, with brokers looking for amazing chances to benefit from the unpredictability of advanced resources. In this unique market, it’s fundamental for merchants to have a profound comprehension of different exchanging signs and examples to settle on informed choices. One such pattern is the Bearish Harami, which holds significance in both traditional financial markets and the realm of cryptocurrencies. This article delves into the intricacies of the Bearish Harami candlestick pattern, its relevance in crypto day trading signals, and its role in the context of crypto signals provided through platforms like Telegram.

Introduction

Somewhat recently, digital forms of money have developed from being a specialty premium to a worldwide monetary peculiarity. Bitcoin, the principal digital currency, was presented in 2009 by an unknown individual or gathering utilizing the pen name Nakamoto. From that point forward, a large number of cryptographic forms of money have been made, each with novel elements and use cases. The phenomenal ascent in the worth of specific digital currencies, like Bitcoin and Ethereum, has drawn in the consideration of brokers and financial backers around the world.

The Significance of Exchanging Signs

Digital money markets are known for their outrageous instability, which presents the two valuable open doors and dangers. While the potential for significant yields is engaging, the unusualness of value developments can prompt significant misfortunes. This is where exchanging signals become possibly the most important factor. Exchanging signals are pointers or examples that propose potential market developments. They act as significant devices for merchants, assisting them with pursuing informed choices in the midst of the tumultuous cost vacillations.

2. Candle Examples and Their Importance Understanding Candle Examples

Candle outlines are a generally involved device in specialized examination. They give experiences into the value developments of a resource over a particular period, frequently as a day, week, or month. Every candle on the graph addresses a particular time span and shows four key sticker costs: the initial cost, shutting cost, most exorbitant cost, and least cost during that period.

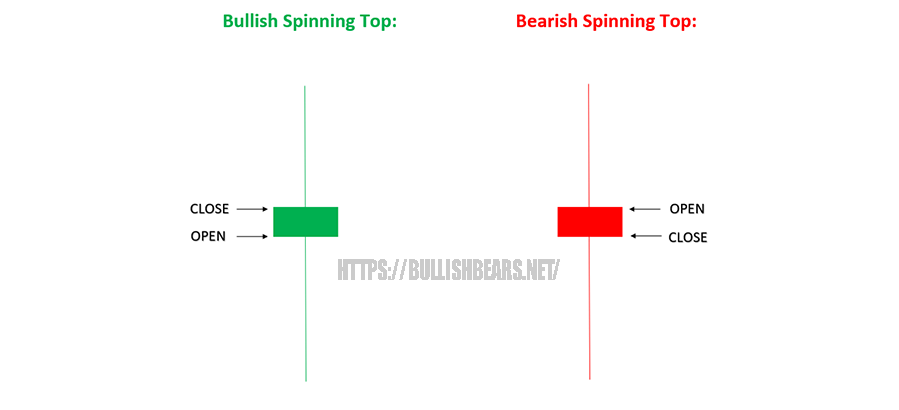

Candle designs are shaped by a mix of at least one candles and proposition important data about market feeling. These examples are ordered into bullish (demonstrating potential cost increments) and negative (showing potential cost diminishes) designs. One such negative example is the Negative Harami.

The Role of Patterns in Technical Analysis

Technical analysis involves the study of historical price and volume data to predict future price movements. Patterns, including candlestick patterns, play a crucial role in this analysis. Traders use these patterns to identify trends, reversals, and potential entry or exit points. By understanding patterns like the Bearish Harami, traders can anticipate shifts in market sentiment and adjust their strategies accordingly.

3. Unveiling the Bearish Harami Pattern What is a Harami Pattern?

The word “harami” is derived from the Japanese term for “pregnant.” In candlestick charting, a harami pattern consists of two candlesticks positioned within each other. The second candlestick is smaller and is contained within the range of the previous candlestick. This pattern suggests a potential reversal in price direction.

Identifying a Bearish Harami

A Bearish Harami pattern is characterized by a large bullish (upward) candlestick followed by a smaller bearish Harami (downward) candlestick. The bearish Harami candlestick is contained within the range of the previous bullish candlestick. The larger bullish candlestick indicates that buyers were in control initially, but the smaller bearish Harami candlestick suggests a potential weakening of buyer momentum and the emergence of selling pressure.

Psychology Behind the Pattern

The Bearish Harami pattern reflects a shift in market sentiment. The large bullish candlestick represents a strong uptrend, indicating that buyers have been dominant. However, the subsequent smaller bearish Harami candlestick shows that the bears are starting to gain traction, leading to a potential reversal. This shift can be attributed to profit-taking by traders who bought during the uptrend and are now looking to secure their gains.

4. Applying Bearish Harami in Cryptocurrency Trading Volatility of Cryptocurrencies

Digital currencies are known at their cost unpredictability, with huge cost swings happening inside brief periods. This instability presents the two valuable open doors and dangers for brokers. While enormous value developments can bring about significant benefits, they can likewise prompt critical misfortunes. Brokers must take on methodologies that record for this unpredictability, and the Negative Harami example can assume a part in such procedures.

Timeframes and Bearish Harami

Different timeframes, such as hourly, daily, or weekly charts, offer varying perspectives on price movements. Traders often use shorter timeframes, such as hourly or 15-minute charts, for day trading, while longer timeframes are suitable for swing or position trading. The Bearish Harami pattern can be identified on various timeframes, allowing traders to tailor their strategies to their preferred trading style.

Risk Management and Stop Loss

Risk management is a critical aspect of successful trading, especially in the volatile cryptocurrency market. Traders should set appropriate stop-loss levels to limit potential losses in case a trade goes against them. The Bearish Harami pattern can serve as an indication that a trend reversal is possible, prompting traders to place tighter stop-loss orders to protect their gains or minimize losses.

5. Crypto Day Trade Signals and Their Types Introduction to Day Trading Signals

Day trading involves opening and closing positions within the same trading day to capitalize on short-term price movements. Day traders rely on various signals and indicators to make swift and accurate decisions. Day trading signals can be generated through technical analysis, fundamental analysis, or a combination of both. These signals aim to provide traders with insights into potential price movements.

Technical Signals vs. Fundamental Signals

Technical signals are derived from the analysis of price charts, patterns, and indicators. Fundamental signals, on the other hand, are based on the analysis of underlying factors that could impact an asset’s value, such as news, events, and market sentiment. While both types of signals have their merits, technical signals are particularly useful for day traders who need real-time information for quick decision-making.

Incorporating Bearish Harami in Day Trade Signals

The Bearish Harami pattern holds significance in day trading signals as it provides insights into potential trend reversals. Day traders who monitor short-term price movements can use the Bearish Harami as a signal to consider short positions or exit long positions. However, it’s essential to remember that no signal is foolproof, and additional analysis, such as confirmation from other indicators, should be considered.

6. The Rise of Crypto Signals Telegram Groups Telegram as a Platform for Crypto Signals

Telegram, a popular messaging app, has become a hub for cryptocurrency enthusiasts and traders. Numerous groups and channels on Telegram provide trading signals, market analysis, and insights into the cryptocurrency market. These groups aim to share information and help traders make informed decisions. However, not all signal providers on Telegram are reliable, and traders should exercise caution when choosing which groups to follow.

Joining and Evaluating Signal Groups

Joining a crypto signals Telegram group can provide traders with access to real-time trading information. When evaluating signal groups, traders should consider factors such as the group’s track record, the transparency of their trading strategies, and the quality of their analysis. It’s important to be wary of groups that make unrealistic claims of guaranteed profits, as trading always carries a degree of risk.

Analyzing Bearish Harami Signals from Telegram

Traders can receive Bearish Harami signals from Telegram groups that focus on technical analysis and trading signals. When a Bearish Harami pattern is identified by the group, it may be shared with members along with additional information, such as potential entry and exit points, stop-loss levels, and the timeframe in which the pattern was spotted. Traders should use this information as a starting point for their own analysis and decision-making.

7. Challenges and Risks in Crypto Trading Market Volatility and Its Implications

Traders must be prepared for rapid and unpredictable price movements that can lead to both profitable and unprofitable trades.

Fake Signals and Scams

The popularity of cryptocurrency trading has led to the emergence of fake signals and scams. Some signal groups may engage in pump-and-dump schemes, where they artificially inflate the price of a cryptocurrency through coordinated buying, only to sell it off at a profit, leaving unsuspecting traders with losses. Traders should be cautious of groups that promise guaranteed profits or use high-pressure tactics to encourage trades.

Importance of Due Diligence

Due diligence is paramount in the world of cryptocurrency trading. Traders should thoroughly research signal providers, analyze historical performance, and assess the validity of claims before acting on any signals. Engaging in proper due diligence helps traders avoid falling victim to scams and make more informed decisions.

8. Strategies for Effectively Using Bearish Harami Signals Confirmation from Other Indicators

While the Bearish Harami pattern can provide valuable insights, traders often use it in conjunction with other indicators to confirm potential trend reversals. Indicators such as the Relative Strength Index (RSI), Moving Averages, and Bollinger Bands can provide additional context and support the decision to enter or exit a trade based on a Bearish Harami signal.

Integrating Fundamental Analysis

While the Bearish Harami is a technical pattern, it’s beneficial to consider fundamental analysis as well. Fundamental factors, such as news, events, regulatory developments, and market sentiment, can impact the validity of a Bearish Harami signal. Combining technical and fundamental analysis can lead to more well-rounded trading decisions.

Case Studies: Successful Trades Using Bearish Harami

Examining real-world case studies can provide insights into how traders have successfully utilized the Bearish Harami pattern. By analyzing historical price charts and the context in which the pattern emerged, traders can learn from past trades and refine their strategies.

9. Technical Analysis Tools for Crypto Traders Moving Averages

Moving averages are commonly used indicators that smooth out price data to reveal underlying trends. Traders often use moving averages to identify potential support and resistance levels and to confirm trend directions. The intersection of short-term and long-term moving averages can serve as an additional confirmation for Bearish Harami signals.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. An RSI value above 70 suggests overbought conditions, while a value below 30 suggests oversold conditions. When combined with a Bearish Harami pattern, an overbought RSI could reinforce the signal for a potential price reversal.

Bollinger Bands

Bollinger Bands consist of three lines: a middle line representing the moving average and two outer bands that show the standard deviation of price movements. When the price approaches the upper Bollinger Band and a Bearish Harami pattern emerges, it could signal a potential reversal from overbought conditions.

Fibonacci Retracements

Fibonacci retracements are used to identify potential support and resistance levels based on key Fibonacci ratios. Traders often use these levels to anticipate price movements after significant price swings. Combining Fibonacci retracement levels with Bearish Harami patterns can provide a comprehensive view of potential reversal points.

10. Realizing the Potential of Bearish Harami Historical Analysis of Bearish Harami in Cryptocurrencies

Analyzing historical price charts of cryptocurrencies can reveal the effectiveness of the Bearish Harami pattern in various market conditions. Traders can backtest the pattern on different cryptocurrencies and timeframes to understand its performance and adaptability.

Adapting to Changing Market Conditions

The cryptocurrency market is known for its dynamic nature, with market conditions constantly evolving. Traders should be prepared to adapt their strategies based on changing trends and market sentiment. While the Bearish Harami pattern can provide valuable insights, it’s essential to combine it with other indicators and analysis methods.

Long-Term vs. Short-Term Trading with Bearish Harami

The Bearish Harami pattern can be effective for both short-term and long-term trading strategies. Short-term traders may use it for quick trades, while long-term traders may incorporate the pattern into their decision-making process to identify potential points of trend reversal for position trades.

11. Future Trends in Cryptocurrency Trading

The involvement of institutional investors and financial firms in the cryptocurrency market is increasing. This trend could lead to greater market stability and regulatory developments, impacting the way traders approach trading strategies.

Regulatory Developments and Their Impact

Regulatory changes can significantly influence the cryptocurrency market. Traders should stay informed about regulatory developments in different regions and consider their potential effects on market sentiment and price movements.

Evolution of Trading Strategies

As the cryptocurrency market continues to mature, trading strategies will likely evolve to incorporate a wider range of tools and techniques. Traders should be open to adapting their strategies to changing market dynamics.

The Art of Trading: Skill and Strategy

Cryptocurrency trading is both an art and a science. Successful traders combine technical knowledge, analytical skills, and emotional discipline to navigate the complexities of the market. The Bearish Harami pattern, along with other technical analysis tools, can contribute to a trader’s toolkit.

Bearish Harami as a Valuable Tool

The Bearish Harami pattern serves as a valuable tool in identifying potential trend reversals, particularly in the context of day trading and short-term strategies. However, traders should exercise caution and use the pattern as part of a comprehensive trading approach that incorporates multiple indicators and analysis methods.

Navigating the Crypto Trading Landscape

As the cryptocurrency market continues to evolve, traders must stay informed about market trends, technological advancements, and regulatory changes. By combining technical analysis, fundamental insights, and risk management strategies, traders can enhance their chances of making informed decisions and achieving success in the dynamic world of crypto day trading.