Bearish Engulfing Candlestick Pattern

In the world of technical analysis, traders and investors constantly seek ways to gain an edge in the markets. One such tool in their toolkit is the Bearish Engulfing Candlestick Pattern. This powerful and widely recognized pattern can provide valuable insights into potential trend reversals and is favored by many traders. In this article, we will delve into the Bearish Engulfing Candlestick Pattern, exploring its characteristics, significance, and how to effectively trade it.

Understanding the Bearish Engulfing Candlestick Pattern

The Negative Overwhelming Candle Example is a two-light inversion design that happens toward the finish of an upswing, flagging a likely shift towards a negative pattern. To distinguish this example, you really want to search for the accompanying attributes:

Significance of the Bearish Engulfing Candlestick Pattern

- Reversal Signal: The Bearish Engulfing Pattern is a potent reversal signal, suggesting that the bulls are losing their dominance, and the bears are gaining control.

- Increased Selling Pressure: The pattern’s formation signifies a surge in selling pressure, often leading to lower prices in the subsequent periods.

- Decision-Making Tool: Traders and investors use this pattern as a decision-making tool to confirm a potential trend reversal and adjust their positions accordingly.

Trading the Bearish Engulfing Candlestick Pattern

Trading the Bearish Engulfing Candlestick Pattern involves several steps:

- Pattern Confirmation: First, verify that the Bearish Engulfing Pattern has formed correctly by ensuring the second candle completely engulfs the first one.

- Wait for Confirmation: While the pattern itself is a strong signal, it’s prudent to wait for confirmation through subsequent bearish price action.

- Entry Point: Consider entering a short (sell) position once the bearish engulfing candle closes. Some traders may wait for a minor bounce or rally before entering.

- Risk Management: Implement risk management by setting a stop-loss order to limit potential losses. Determine your take-profit levels based on your trading strategy and risk tolerance.

- Monitoring the Trade: Keep a close eye on the market to adjust your position if necessary. Trailing stop-loss orders can be useful for locking in profits.

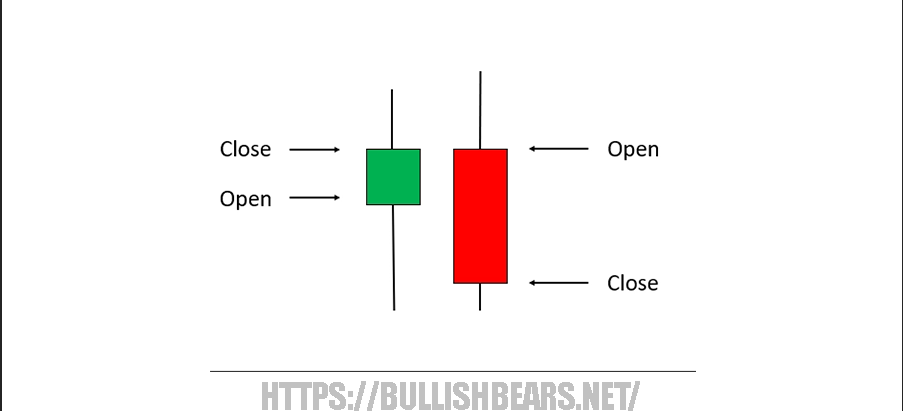

- Prior Trend: The market should be in a clear uptrend before the Bearish Engulfing pattern appears.

- First Candle: The first candle is typically a bullish (upward) candle, indicating that the buyers are in control.

- Second Candle: The second candle is a bearish (downward) candle that completely engulfs the previous bullish candle. In other words, the second candle’s body should open above the first candle’s close and close below the first candle’s open.

- Significance of the Bearish Engulfing Candlestick Pattern

- Reversal Signal: The Bearish Engulfing Pattern is a strong reversal signal, suggesting that the bulls are losing their grip on the market, and the bears are taking over.

- Increased Selling Pressure: The pattern’s formation signifies an increase in selling pressure, often leading to lower prices in the subsequent periods.

- Confidence Builder: Traders and investors use this pattern to gain confidence in a potential trend reversal, helping them make more informed decisions.

Trading the Bearish Engulfing Candlestick Pattern involves the following steps:

- Identify the Pattern: Confirm that the pattern has formed correctly by ensuring the second candle completely engulfs the first one.

- Wait for Confirmation: While the pattern itself is a strong signal, it’s often wise to wait for confirmation through subsequent bearish price action.

- Entry Point: Consider entering a short (sell) position as soon as the bearish engulfing candle closes. Some traders may also wait for a slight pullback before entering.

- Stop-Loss and Take-Profit: Implement proper risk management by setting a stop-loss order to limit potential losses. Determine your take-profit levels based on your trading strategy and risk tolerance.

- Monitor the Trade: Keep a close eye on the market to adjust your position if necessary. Trailing stop-loss orders can be useful to lock in profits.

Conclusion

The Bearish Engulfing Candlestick Pattern is a valuable tool for traders looking to identify potential trend reversals in financial markets. By understanding its characteristics and significance, traders can make more informed decisions and increase their chances of successful trading.

However, remember that no trading pattern is foolproof, and risk management is essential to protect your capital. As with any trading strategy, practice and experience are crucial for effectively using the Engulfing Candlestick Pattern.